Crowdfunding vs. Grants: Which Should You Choose?

Choosing between crowdfunding and grants can determine the success of your project or venture. Both are popular ways to raise funds in the United States, but they differ greatly in approach, timeline, and requirements.

This comprehensive guide will explain what each funding method entails, compare their pros and cons, and help you decide which option (or combination) is best suited for nonprofits, startups, students, artists, and more.

We’ll also provide up-to-date examples, key differences in a handy table, and answers to frequently asked questions.

Understanding Crowdfunding

Crowdfunding is a fundraising method where a large number of people each contribute relatively small amounts of money, typically via an online platform. In practice, an individual or organization pitches a project or cause on a crowdfunding site, and supporters (the “crowd”) donate or pre-purchase products to help reach a funding goal.

Crowdfunding success often hinges on compelling storytelling, strong marketing, and community engagement. In the U.S., crowdfunding has become mainstream – for instance, Kickstarter (a major platform for creative projects) has facilitated over $8 billion in pledges to date, and overall crowdfunding campaigns raised more than $20 billion in 2023.

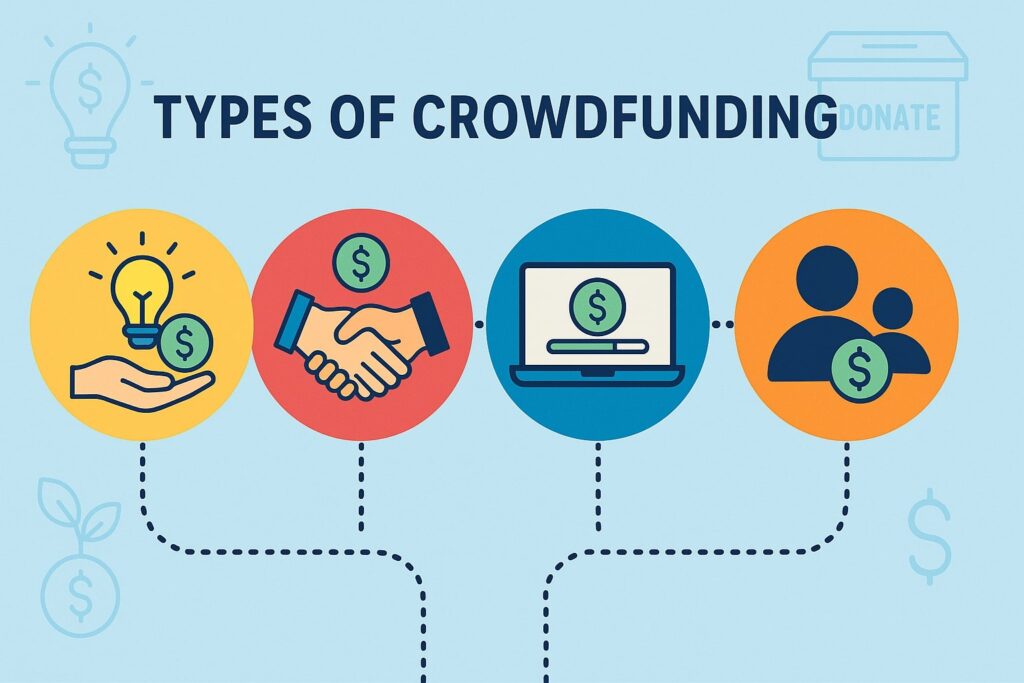

Types of Crowdfunding

There are several models of crowdfunding, each suited to different needs:

- Donation-Based Crowdfunding: Supporters donate money without expecting anything in return. Common for charitable causes, medical bills, or community projects (e.g. GoFundMe campaigns). Backers give out of goodwill, and contributions are essentially donations.

- Reward-Based Crowdfunding: Backers contribute in exchange for a reward or product pre-order. This is popular for creative projects, new gadgets, or artistic works.

Platforms like Kickstarter and Indiegogo allow creators to offer tiers of rewards (merchandise, early access, copies of the product, etc.) to supporters. - Equity Crowdfunding: Investors in the crowd receive a small equity stake or shares in the business in return for funding. This became legally possible in the U.S. after the JOBS Act, and platforms like Wefunder, StartEngine, and Republic facilitate equity crowdfunding for startups.

In 2023, companies raised around $423 million through regulated equity crowdfunding (Reg CF) in the U.S. Unlike donation/reward crowdfunding, this model involves selling ownership, but it’s non-dilutive for donors in the sense that they expect a return on investment rather than a reward. - (Other forms like debt crowdfunding or peer-to-peer lending also exist, but those are less common for most small projects and are more like loans.)

Popular Crowdfunding Platforms (U.S.): For donations and rewards, well-known platforms include Kickstarter (creative projects), Indiegogo (tech and creative campaigns), GoFundMe (personal and charitable causes), and Patreon (ongoing fan subscriptions).

There are also niche platforms, such as Kickstarter’s success in gaming projects (over $2.5 billion raised in games category) or FundRazr for nonprofit causes (with a high 42% success rate). Each platform has its own community and focus, so choosing the right one can influence your campaign’s reach.

How Crowdfunding Works

A typical crowdfunding campaign lasts around 30–60 days on platforms like Kickstarter. The process usually involves:

- Creating a campaign page: This includes a project description, goals, funding target, deadline, and often a pitch video and images. You set reward tiers if applicable.

- Launching and promotion: Once live, you must actively promote the campaign via social media, email, press outreach, and personal networks. Early momentum is crucial – about 30% of crowdfunding funds often come from the creator’s personal network initially.

- Engaging backers: Successful campaigns provide updates and interact with supporters throughout the funding period. Strong engagement can encourage more contributions.

- All-or-nothing vs. flexible funding: Many platforms (like Kickstarter) are all-or-nothing – you only receive the money if you meet or exceed your funding goal by the deadline.

Others (Indiegogo has a flexible option) allow you to keep funds raised even if the goal isn’t met. All-or-nothing models motivate backers and reduce risk of underfunded projects. - Post-campaign fulfillment: If successful, you’re responsible for delivering the promised product or rewards to backers. This can take months of work (manufacturing a product, shipping rewards, etc.), and failure to fulfill can damage your reputation. Communication with backers is expected throughout this phase.

Speed: Crowdfunding can provide funding relatively quickly. Campaigns themselves run just weeks, and you’ll usually receive funds soon after the campaign (minus platform fees). This makes crowdfunding suitable for projects that need money on a short timeline (a few months).

Cost and Fees: Crowdfunding isn’t free money – platforms typically charge 3-8% of funds raised as a fee, plus payment processing fees (~3%). You might also spend money on creating a prototype, marketing your campaign (advertising, video production), and fulfilling rewards.

These costs can total 10–30% or more of the funding target in practice for a well-run campaign. It’s important to budget for these expenses so you don’t come up short after the campaign.

Success Rates: Crowdfunding is competitive and far from a sure bet. On average, less than 25% of campaigns meet their funding goal. On Kickstarter, the historical success rate is around 36%, though it varies by category (for example, comics or tabletop games often see higher success rates, whereas some categories see lower).

Effective marketing and a strong pitch are essential to beat these odds. The campaigns that do succeed typically have hundreds of individual backers (the average successful campaign has ~300–400 backers), which shows the importance of reaching a wide audience.

Benefits Beyond Money: A unique strength of crowdfunding is community building. A campaign can double as a marketing event – raising awareness and rallying a community around your idea. Backers often become evangelists for your project.

For example, nonprofits have found that crowdfunding not only raises funds but also deepens relationships and community trust. Early supporters feel invested in your success.

Additionally, a successful crowdfunding campaign can serve as market validation for a product or idea – demonstrating public demand, which might attract media attention or additional investors/grantmakers later.

Understanding Grants

Grants are funds given by institutions – such as foundations, corporations, or government agencies – to support specific projects or organizations. Unlike loans, grants do not need to be repaid, and unlike equity investments, they don’t require giving up ownership.

In essence, grants are gifts with strings attached: you must use the money for a designated purpose and adhere to the funder’s requirements. Grant funding is especially common in the nonprofit sector, research, education, and certain startup or arts initiatives.

A grant typically involves a formal application process (often called grant writing when proposals are involved). You submit a detailed proposal or application by a deadline, explaining your project, budget, and how it aligns with the grant’s purpose.

The funding agency or committee then reviews submissions and selects winners. This process can be highly competitive – success rates for grants might range from about 10% to 30%, depending on the grant type and source.

For instance, a local corporate grant might have a higher chance than a large federal research grant, but either way you should expect stiff competition.

Sources of Grants in the U.S.: There are thousands of grantmakers. Key categories include:

- Government Grants: Federal, state, or local government agencies offer grants for public purposes (e.g. scientific research, small business innovation, community development, education, the arts).

For example, the U.S. Small Business Innovation Research (SBIR) program provides over $3 billion per year in grants to small businesses developing cutting-edge technology.

The National Endowment for the Arts (NEA) offers grants to artists and arts organizations. These grants often involve lengthy proposals and strict reporting if won. - Foundations: Private foundations (like the Ford Foundation, Bill & Melinda Gates Foundation, or smaller family foundations) fund projects aligned with their missions (such as poverty alleviation, education, arts, etc.).

Foundations might offer grants to nonprofits or individuals (like artists) for projects that match specific focus areas. For example, the Doris Duke Charitable Foundation funds arts, medical research, and more. - Corporate Grants: Many corporations have philanthropic arms or community grant programs (e.g. Walmart Foundation provides grants for community and sustainability initiatives). These might be smaller awards but often with simpler applications.

- Academic and Research Grants: Universities, research institutions, and agencies like the National Science Foundation (NSF) or National Institutes of Health (NIH) offer grants for research projects.

These are typically available to faculty, students or partner organizations for scientific and educational research. - Nonprofit and Community Grants: Large nonprofits or community foundations re-grant funds to local projects. For instance, community foundations in many cities offer small grants to local nonprofits or artists.

Grants can range from a few hundred dollars up to millions. A foundation may give a $5,000 grant to a community art project, whereas a federal agency might award a $500,000 research grant. Grant funds might be one-time or multi-year.

The table below illustrates some typical ranges and timelines – for example, U.S. government grants often take 3–12 months from application to decision and have success rates around 10–25%, while foundation grants might take a few months with ~15–30% success odds:

| Grant Source | Typical Timeline | Typical Amount (USD) | Success Rate |

|---|---|---|---|

| Government Grants (e.g. federal programs) | 3–12+ months (long review cycle) | Tens of thousands up to millions (major federal awards) | ~10–25% (highly competitive) |

| Foundation Grants (private foundations) | 2–6 months | ~$5,000 to $250,000 (varies by foundation) | ~15–30% |

| Corporate Grants (business philanthropy) | 1–4 months | ~$2,000 to $100,000 | ~20–40% (often smaller pool of applicants) |

| Research/Academic Grants (universities, NIH, etc.) | 6–18 months (including approvals) | $50,000 to $2M+ | ~5–20% (very competitive) |

Note: These figures are illustrative – each grant program is different. Some local or niche grants might have higher success chances, while prestigious national grants could have single-digit success percentages.

- Eligibility: Grants often have strict eligibility criteria. Many grants, especially foundation and government grants, require the applicant to be a registered nonprofit (501(c)(3)) or a public institution. This is why nonprofits frequently seek grants.

Some grants allow individuals to apply (common in the arts and academia), but even then you may need a fiscal sponsor or an established organization to receive the funds on your behalf.

Businesses can access grants mainly through specific programs like economic development or innovation grants.

Always check the criteria – grants may be limited by geography (e.g. only to residents of a certain city or state), by the type of project, or by other factors (for example, grants for women-owned businesses or minority entrepreneurs). - Application Effort: Applying for a grant can be time and labor intensive. You typically must prepare a detailed proposal that includes: a project narrative, a budget, a timeline or work plan, and documentation of your organization’s capacity (e.g. past achievements, resumes of team, letters of support).

Writing a strong grant proposal requires skill – many people hire professional grant writers or consult guides to improve their applications. It’s not uncommon for a single grant proposal to take weeks or months of preparation and revision.

And importantly, you might apply and get zero funding if you’re not selected, which means that effort yields no immediate payoff. This contrasts with crowdfunding, where even an unsuccessful campaign can raise some awareness or partial funds (especially on flexible funding platforms). - Timeline: Grant funding is not quick. From the time you start researching to the time you receive money can easily be 6 months to a year (or more). For example, on average it takes around six months to secure a grant (per an analysis by Candid).

Many grants have fixed deadlines (often annual or quarterly cycles), after which you wait for a decision. If you’re awarded, there might be additional paperwork (contracts, setting up accounts) before funds are released.

This means grants are better for projects that have a longer lead time and can plan far ahead, rather than emergencies or urgent needs. - Strings Attached: While grants are free money in that you don’t repay them, they do come with obligations. Grant providers usually require reports on how you spent the money and what you achieved.

There may be conditions on how funds can be used – for instance, some grants won’t pay for overhead or salaries, only direct project costs, or they might restrict funds to certain line items (known as allowable costs).

You must be prepared for administrative work like tracking expenses and writing periodic progress reports for the funder. Non-compliance with grant terms can jeopardize current or future funding.

Essentially, grants hold you accountable to the funder’s expectations, whereas crowdfunding holds you accountable primarily to your backers/community. - Advantages of Grants: The big draw is that grants can provide large amounts of funding without diluting ownership or incurring debt. For nonprofits or researchers, grants might be one of the only ways to get significant funding.

Being awarded a reputable grant can also lend credibility and prestige to your project – it’s a vote of confidence from established institutions. Grants can sometimes be repeated or renewed (e.g. an annual grant you can win multiple times) providing ongoing support. - Challenges of Grants: As discussed, they are competitive and slow. Grant writing also requires a certain expertise and capacity – small organizations might struggle with the paperwork or lack the track record funders want to see.

Additionally, focusing too much on grants can sometimes pull organizations away from their grassroots support; nonprofit leaders note that relying on foundation grants may reduce direct accountability to community members.

This is why some nonprofits balance grants with fundraising from individual donors (including crowdfunding) to stay connected with their base.

Key Differences Between Crowdfunding and Grants

Crowdfunding and grants both fund projects, but they operate very differently. The table below highlights the key differences:

| Factor | Crowdfunding | Grants |

|---|---|---|

| Source of Funds | The general public – numerous individual backers contribute small to moderate amounts online. Platforms like Kickstarter or GoFundMe connect you to everyday people. | Institutions – funding comes from foundations, government agencies, corporations, or trusts, usually in larger lump sums. |

| Nature of Funding | Typically donations or pre-orders. Backers may get a reward or product, but no financial return (unless it’s equity crowdfunding). Non-dilutive for donations/rewards (you don’t give up ownership). Equity crowdfunding is an exception where you offer shares. | Non-dilutive grants (no equity or ownership given away). Treated as a gift for a purpose. No repayment required as long as terms are met. |

| Application vs. Campaign | Create a public campaign page and pitch; anyone interested can contribute. No formal “application” or gatekeeper – the crowd decides if they like your idea by funding it. | Submit a formal application or proposal to the grantmaker. A review committee or funder decides whether you fit their criteria and merit funding. It’s a selective process. |

| Timeline to Funds | Fast – Campaigns usually run 1–2 months, and you get money shortly after if successful. Good for quick funding needs. | Slow – Can take months to over a year from writing proposal to receiving funds. Grants work on fixed cycles and reviews, not ideal for immediate needs. |

| Effort & Skills Required | Emphasis on marketing and engagement: you must pitch to the public, produce a video or visuals, promote on social media daily, and excite backers. Storytelling and networking are key skills. | Emphasis on paperwork and planning: you need strong writing skills to craft proposals, data and metrics to support your case, and attention to detail for compliance. Grant writing and project planning are key skills. |

| Amount Raised | Variable – often smaller amounts per backer, total depends on crowd size. Many campaigns raise a few thousand to tens of thousands. Some exceptional campaigns raise millions, but average successful campaign is ~$8K. | Potentially large – grants can fund bigger budgets. Common grants range $5K–$100K, and some go into six or seven figures. You might get more money in one grant than an entire crowdfunding campaign, if you win. |

| Success Rate | Low to moderate: Roughly 20–40% of campaigns succeed in hitting goal. Success depends on appeal to donors and marketing execution. If you don’t attract the crowd, you get nothing (especially on all-or-nothing platforms). | Low: Perhaps 10–30% of grant applications get approved. Even well-written proposals can be turned down due to limited funds or fit. It’s not guaranteed money and often requires multiple tries. |

| Costs/Fees | Platform fees (typically ~5-8%) + payment processing (3%) eat into funds. Also consider cost of reward fulfillment (manufacturing, shipping) and marketing. Overall, a chunk of what you raise goes back out as expenses. | Usually no upfront fee to apply, but significant time investment. Some organizations hire grant writers or consultants (which can cost money). Once awarded, you must spend funds on project and reporting, which takes staff time (administrative overhead). |

| Accountability | Direct accountability to backers and the public. You owe your supporters updates and the promised rewards. A failed delivery can harm your reputation. Backers serve as your community and can offer feedback. | Accountability to funder. Must meet the funder’s requirements: use money as agreed, provide reports, outcomes, and metrics. Your responsibility is to the grantor (and by extension, the mission criteria they set), which can mean less public visibility. |

| Flexibility of Use | Generally flexible within the project scope – you set the campaign goal for what you need funding for. After funding, as long as you deliver what was promised, you have discretion in spending. (Donors don’t usually micromanage your budget, though you should honor your plan). | Often restricted to approved budget items. Grants may specify how funds can be allocated (e.g. equipment only, or no more than X% on overhead). You might not be allowed to shift funds between categories without approval, making it less flexible. |

| Ideal For | Consumer-facing ideas, creative projects, personal causes, early-stage concepts that need public validation. Examples: a new gadget or game, an indie film, a community fundraiser, a medical expense fundraiser. It’s great if your target “funders” are ordinary people who care about your story or product. | Social impact initiatives, research, large-scale programs, or anything that aligns with a funder’s mission. Examples: a nonprofit program addressing community needs, a scientific research project, a tech R&D project, an educational or arts program. Grants shine when you have a clear public benefit or innovation to demonstrate to experts. |

| Risks and Downsides | Possible campaign failure (publicly visible) which can be discouraging. If you succeed, risk of delays or cost overruns in delivering rewards – many crowdfunded projects struggle with manufacturing, causing frustration or reputational damage. Also, a heavy time investment in marketing might divert from project development. | Uncertainty and hidden effort: you might invest months into applications and get nothing. Strict compliance burden – paperwork during and after the project. Funds can be limited in scope (only for specific use). Relying on grants can lead to mission drift (chasing funding vs. your original mission) if not careful. |

As shown above, crowdfunding is generally faster and driven by public appeal, whereas grants are slower and driven by institutional priorities and merit. Crowdfunding demands marketing hustle; grants demand bureaucratic diligence. One involves many small donors, the other typically a single large donor.

Pros and Cons of Crowdfunding

Crowdfunding can be a powerful tool, but it also has its pitfalls. Below we break down the major advantages and disadvantages:

Advantages of Crowdfunding

- Quick Access to Capital: You can raise money relatively quickly, sometimes in a matter of weeks. This is ideal for time-sensitive needs or capitalizing on a trend. A typical campaign wraps up in 1-2 months, far faster than waiting for a grant decision.

- No Debt or Equity Loss (for donation/reward campaigns): Funds raised are essentially non-dilutive – you don’t have to pay anyone back or give up ownership in your project. Backers contribute because they believe in your idea or want your reward. You retain full control of your venture.

- Publicity and Marketing Benefits: A crowdfunding campaign can double as a marketing campaign. As you promote it, you raise awareness about your project. Media outlets might cover an exciting campaign, and word-of-mouth can spread.

By the end, you may have an email list of supporters and a base of early adopters, which is valuable for future efforts. - Community Building and Validation: Crowdfunding lets you build a community around your idea. Supporters feel like part of a team making something happen. This not only provides moral support, but also market validation – proving that real people are willing to vote with their wallets.

That validation can help convince other funders or partners later. It’s a great way to test the demand for a product or concept before fully committing. - Flexibility and Creativity: You can structure your campaign as you see fit – set your own funding goal, create fun reward tiers, and tell your story your way. This creative freedom can be empowering (and also allows for unique projects that might not fit typical grant criteria).

- Inclusivity: Crowdfunding is open to anyone with an idea – you don’t need to be an established organization or have a nonprofit status. This makes it accessible for individuals like students or artists who might not qualify for grants.

It can democratize fundraising, as people from all backgrounds can try their hand at raising money.

Disadvantages of Crowdfunding

- High Effort in Marketing & Promotion: “If you build it, they won’t just come.” Crowdfunding success demands relentless promotion and social media marketing throughout the campaign.

Founders often find themselves spending every day reaching out to potential backers, thanking donors, making updates, and keeping the momentum. It can be like a full-time job for the campaign duration. - Uncertain Outcome: The majority of crowdfunding campaigns do not reach their funding goal. There’s no guarantee of any money unless you succeed (especially on all-or-nothing platforms).

You might invest significant time and even money (on a campaign video, etc.) and end up with nothing if the campaign fails. This uncertainty can be stressful and is a risk to manage. - Fees and Costs Eat Into Funds: Between platform fees (~5-8%) and payment processing (~3%), you lose a chunk of what you raise. Additionally, fulfilling rewards can be expensive – producing merchandise or products for backers, shipping costs (which can be global), packaging, taxes on funds, etc.

Many creators underestimate these costs. If you promised a T-shirt to every $25 backer, for example, the printing and mailing costs will cut into your net funds. It’s crucial to budget properly. - Need an Existing Network: Crowdfunding isn’t truly “free money from strangers on the internet.” Often, a campaign’s initial traction comes from people you know – friends, family, colleagues. On average, about 30% of crowdfunding funds come from the creator’s personal network early on.

If you don’t have a supportive network or audience to tap into, it’s much harder to get the ball rolling. Campaigns can stall without early momentum, as people hesitate to back projects that look like they might not hit the goal. - All-or-Nothing Pressure: If using a platform like Kickstarter, failing to reach 100% of your goal means you get zero funds.

This can be a pro (it motivates backers to push you over the finish line, and protects you from being obligated to do a project without enough money) but it’s also a con if you end at 99% and get nothing.

Some platforms offer flexible funding, but those come with their own challenges (you must still deliver something even if underfunded). - Reputation & Obligation to Deliver: When a campaign succeeds, the work isn’t over – in fact, it’s just beginning. You must deliver on your promises to backers. Delays and failures can lead to public backlash.

Many crowdfunded projects (especially tech gadgets and games) have infamously run into delays or shipping problems, frustrating backers. A high-profile example was the “Coolest Cooler” which raised over $13 million but struggled with production, leaving many backers unhappy.

If things go wrong, your reputation can suffer. You’ll need solid planning and communication to avoid pitfalls (e.g., set realistic timelines, update backers frequently to maintain trust). - No Expert Guidance or Endorsement: Unlike grants or investors, crowdfunding backers generally don’t provide guidance or expertise (though some may give suggestions).

You won’t get the kind of mentorship or credibility that might come from, say, an investor or grantor being on board. The crowd believes in you, but they’re not going to help execute the project. You’re on your own to deliver.

In summary, crowdfunding is fast and empowering but also uncertain and labor-intensive. It works best when you have a compelling story or product that can attract everyday people’s interest, and when you’re prepared to hustle for every dollar and then fulfill your promises.

Pros and Cons of Grants

Now let’s consider the upsides and downsides of pursuing grants as a funding strategy:

Advantages of Grants

- Larger Funding Amounts in One Go: Grants can provide a significant infusion of funds that might take dozens of small crowdfunding campaigns to match.

For example, a single government or foundation grant could be $50,000 or $500,000+, which for most crowdfunding campaigns would be a very high target. If your project requires a substantial budget (six figures or more), grants may be a more realistic avenue. - No Repayment, No Equity Loss: Grants are essentially free money for your project (with conditions). You don’t have to pay interest as you would on a loan, and you’re not giving up company shares or control as you would with investors.

The capital is non-dilutive – it’s a gift to support your work. This is why startups and nonprofits alike covet grants, since they can fuel growth without financial burden later. - Legitimacy and Credibility: Being awarded a grant often serves as a stamp of approval from an authoritative source. It signals that experts or officials believe in your project’s merit. This can boost your credibility in the eyes of other funders, partners, or the public.

For instance, if your nonprofit wins a grant from a prestigious foundation, it’s newsworthy and builds trust with donors. Startups that receive federal innovation grants can advertise that achievement when approaching investors, showing that their tech was validated by a competitive program. - Supports Specific Missions: Grants are designed to fund work that has social, scientific, or artistic value – often things that might struggle to attract commercial financing.

If your project aligns with a grant’s mission (say, environmental conservation or advancing the arts), grant funding enables you to pursue it without needing it to be “marketable” to the general public.

In other words, grants can fund important projects that crowdfunding audiences might not understand or find exciting, as long as the grantor sees the value. - Can Cover Operational Costs and Scale: Some grants (especially multi-year ones or general operating grants from foundations) can support your organization’s capacity building, equipment, staff salaries, etc.

Crowdfunding is usually project-focused and one-off; grants can sometimes help build infrastructure or allow you to undertake long-term projects that need sustained support. - Expert Feedback: In some cases, even if you don’t win a grant, you might get feedback from the review panel on how to improve your proposal next time.

Applying for grants can push you to refine your project plans, clarify goals and evaluation methods, which ultimately strengthens your project. This kind of rigorous planning is a positive side effect of the grant process.

Disadvantages of Grants

- Highly Competitive (Low Odds): The big caveat with grants is that everyone wants free money. Popular grant programs might fund only a small fraction of applicants. This means you can spend weeks crafting a proposal and still get a rejection due to limited slots.

As noted, success rates often hover around 10–20%, or even lower for elite grants. You might face competition from organizations with more experience or resources. It can be demoralizing to get denied repeatedly. - Slow Funding Timeline: Grants are not a quick fix. From researching opportunities, writing the application, waiting for the decision, to actually receiving the funds (and sometimes funds are reimbursed after expenses, adding more delay), it’s a long game.

If you need immediate cash, grants won’t solve that. The average grant can take ~6 months or more from start to finish. This slow timeline can be problematic if your project is time-sensitive or if you have a short runway financially. - Extensive Paperwork and Conditions: Applying for a grant is like writing a thesis – you may need a detailed proposal often 10+ pages long, a theory of change, logic models, budget justifications, and heaps of supporting documents.

This can distract from actually executing your project. And if you win, the paperwork isn’t over: you’ll need to sign grant agreements (sometimes with legal oversight), track every penny spent, and produce progress reports or presentations to the funder.

The administrative burden can be heavy, especially for small teams. Compliance requirements (like undergoing audits or adhering to federal regulations if it’s government money) are a serious responsibility. - Less Creative Freedom: When you take a grant, you’ve agreed to pursue a project as outlined in your proposal. Making changes often requires the funder’s approval.

You can’t easily pivot or use the funds for a different opportunity that arises, as you might with unrestricted crowdfunding money. This rigidity means you must forecast your needs well in advance.

Also, grantmakers might steer your project in subtle ways – you might tailor your plans to fit what you think they want, potentially compromising your initial vision. - Eligibility Hurdles: Not everyone can apply for every grant. Many grants exclude individuals or for-profit entities.

If you’re an individual artist or an entrepreneur, you might have to find specific grants that allow you to apply, or partner with a nonprofit as a fiscal sponsor.

The need for nonprofit status or academic affiliation can block some people out of the grant world. By contrast, anyone can launch a crowdfunding campaign. - Dependence and Sustainability: Grants are typically one-time infusions (even if they are multi-year, they have an end date). Organizations that rely too heavily on grants may find themselves in a funding crunch when a grant ends.

There’s also a risk of “chasing grants” – drifting your mission or starting new projects just to qualify for available grants, which can lead to mission creep. If a major grant isn’t renewed, it can leave a big hole in your budget.

Crowdfunding usually yields smaller amounts, but those can be repeated or diversified (and individual donors might give again and again). - Accountability to Funders: While accountability itself isn’t a bad thing, the dynamic in grants means you’re trying to satisfy a relatively small number of decision-makers (the funder or grant committee), as opposed to crowdfunding where you’re accountable to a broad base of supporters.

Some critics say that in the nonprofit world, an over-reliance on grants can make organizations more beholden to foundation priorities than to the communities they serve.

In other words, you might spend more time catering to reporting requirements and funder preferences than actually engaging with your constituents on the ground.

In summary, grants offer high reward but also high effort and risk (in terms of chance of failure and administrative load). They are excellent if you need substantial funding for a well-defined project and you qualify for the opportunity, and if you can afford to invest the time in the process.

For many nonprofits and research projects, grants are a lifeline. But for scrappy new ventures or urgent needs, grants can be frustrating or impractical. Often, the best approach is to integrate grants as one part of a broader funding strategy, rather than the sole source.

How to Decide: Key Factors to Consider

Every project is unique, and the “crowdfunding vs. grants” decision depends on several factors. Here are key considerations to help you choose the right path for your situation:

- Urgency of Funding: Do you need money quickly or can your project wait? If you have an immediate financial need or a time-sensitive opportunity, crowdfunding is likely the better route, as successful campaigns yield funds in a couple of months or less.

Grants require patience – you might be looking at next year before seeing money. For example, if you’re launching a prototype in six weeks, a crowdfunding campaign could rally support in time, whereas a grant you apply for now might not come through until long after the opportunity has passed. - Amount of Funding Needed: How much money do you realistically need? Crowdfunding tends to work best for small to mid-sized goals – raising a few thousand up to maybe tens of thousands of dollars (though there are outliers above that).

The average crowdfunding campaign raises about $7–8k, so while you can aim higher, your strategy must be exceptional to gather, say, $100k from the crowd. Grants, on the other hand, can supply larger sums, so if your budget is significant (six-figures or more), identifying relevant grants might be more effective.

It could be easier to win one $100k grant than to convince 5,000 people to each give $20. However, note that high-dollar grants are correspondingly harder to get. - Type of Project and Appeal: Consider who would be excited to fund your project. If it’s something with broad public appeal or a compelling human story – for example, an invention that tech enthusiasts would love, a community garden that neighbors care about, or a documentary film on a trending topic – crowdfunding taps into public passion.

Conversely, if your project is highly technical, specialized, or yields a public good rather than a private good, a grant might be more appropriate.

For instance, a research project to develop a new cancer therapy might not get the average person to open their wallet (they’d rather see proven results), but a health research grant committee could find it worthwhile.

Or an initiative that helps a specific underserved community might resonate with a foundation’s mission more than with strangers online. You have to judge whether your funding story will resonate more with crowds or with committees. - Your Network and Community: Do you have an existing community of supporters, fans, or constituents? Crowdfunding campaigns are far more likely to succeed if you can mobilize a base of people who care about you or your cause.

Before choosing crowdfunding, take stock of your reach: email lists, social media followers, personal contacts, local community etc. If these numbers are small, you might struggle to crowdfund (though it’s not impossible – you can try to get media coverage or leverage a viral angle).

Grants don’t require you to bring an audience; instead, they require you to impress a handful of reviewers. If you lack a network but have a strong proposal on paper, grants might be easier to pursue.

On the other hand, if you have a large, engaged following (say you’re a creator with many fans), crowdfunding can be incredibly fruitful and also liberating (you answer directly to your fans). - Skill Set and Team Capacity: Reflect on what you or your team are better at (and enjoy more): marketing or grant writing? These are very different tasks.

Crowdfunding will have you designing graphics, making videos, running social media campaigns, and constantly interacting with the public. It favors outgoing, storytelling-oriented, hustle-heavy work.

Grant seeking involves research, writing detailed narratives, crafting budgets, and painstakingly aligning with guidelines. It’s more about quiet, behind-the-scenes work and attention to bureaucratic detail. Consider which plays to your strengths.

Also, think about capacity: a nonprofit with a development staff may be well equipped to churn out grant applications, whereas a solo entrepreneur might find that overwhelming and do better rallying a community via crowdfunding. - Project Timeline and Flexibility: If your project can be broken into phases, you might not need all the money upfront. Crowdfunding could get you started with a prototype or pilot phase, which you can execute quickly.

If the project requires full funding to do anything (like constructing a building or running a 3-year program), a grant that covers the comprehensive budget might be necessary. Also, how flexible is your project’s scope?

Crowdfunding outcomes are variable – you might raise more or less than expected. If you can scale your project up or down based on funds raised (e.g. print 500 books vs. 1000 books depending on budget), crowdfunding offers that flexibility.

If the project needs a fixed sum to be viable, grant funding (or an all-or-nothing campaign) could be more suitable to ensure you hit that number. - Public Engagement vs. Privacy: Crowdfunding is a very public endeavor. You’re essentially advertising your need for money to the world. For some causes, that publicity is a bonus (awareness, community support).

But in other cases, you might prefer discretion. For example, if you’re fundraising for a sensitive project (like a controversial social issue) or you simply are a private person, you might not want to campaign openly.

Grant applications are typically confidential and internal to the funding organization. You don’t have to announce to everyone that you applied or if you failed to win.

So consider your comfort with public campaigning. Additionally, public campaigns can expose you to feedback – sometimes negative or trollish feedback – whereas grant feedback is private. - Requirement of Nonprofit Status or Partnership: If you are not a nonprofit but your project is socially oriented, determine if you have a path to apply for grants.

This might involve partnering with a nonprofit as a fiscal sponsor (who can accept the grant on your behalf). Fiscal sponsorship is common for artists or small community projects – the sponsor takes a fee and handles the grant administration.

If that’s too complicated or not possible, crowdfunding could be the way to gather funds for a cause without formal nonprofit status.

For students or personal causes, grants in the traditional sense are few (aside from scholarships or fellowships), so crowdfunding is often the fallback. - Long-Term Funding Strategy: Think beyond just this project. Crowdfunding is usually a one-time task (though you can run multiple campaigns or use Patreon for ongoing support). Grants can sometimes be renewed or lead to additional grants if you build a good reputation.

However, grants can also dry up if priorities change. Ideally, a sustainable funding strategy might involve multiple streams. If you foresee needing continuous funding, consider how each method plays into your plan.

For example, a nonprofit might use crowdfunding to build a donor base for unrestricted funds while also pursuing grants for specific programs – thereby not putting all eggs in one basket.

In many cases, the decision isn’t purely one or the other. You might start with one and transition to or combine the other. We’ll discuss hybrid approaches next, because some of the most successful projects leverage both crowdfunding and grants over time to maximize funding.

Crowdfunding vs. Grants: What’s Best for Your Situation?

Let’s examine a few common scenarios and project types, and how crowdfunding or grants (or both) tend to fit:

Nonprofit Projects and Community Initiatives (Founders of Nonprofits)

If you run a nonprofit or community project, you’re likely familiar with grants as a traditional funding source. Grants are well-suited for nonprofits because they often require 501(c)(3) status and align with charitable missions.

For instance, if you’re running an after-school program or a neighborhood revitalization project, you might seek foundation or government grants geared toward education or community development. Grants can underwrite large programs or capacity-building that individual donations alone might not cover.

However, nonprofits shouldn’t overlook crowdfunding. Crowdfunding can energize your grassroots support and raise flexible funds for a specific project or need. It’s also a great way to engage your community – people who donate feel more connected to your work.

For example, a small nonprofit could crowdfund $10,000 for a new piece of equipment or a specific community event, getting buy-in from local supporters, while still pursuing grants for their general operating costs.

Crowdfunding can fill gaps (like when a grant comes up short or an emergency expense arises). It’s also useful for new nonprofits that might not yet have grant access – a passionate crowdfunding campaign can jumpstart your budget and prove community interest in your mission.

US Context Tip: Many U.S. donors to crowdfunding campaigns won’t get a tax deduction for their contributions unless the campaign is run by a registered charity.

If you are a nonprofit, you can make donations tax-deductible (e.g., through platforms that partner with nonprofits or by issuing receipts). This can encourage larger gifts. But even without that, people give if the cause moves them.

Platforms like Mightycause or Classy cater to nonprofit crowdfunding, and mainstream ones like GoFundMe are also commonly used for charitable causes.

Bottom line for nonprofits: Use grants to land the big funds for your core programs, but consider crowdfunding for specific projects, matching challenges, or engaging younger donors.

Crowdfunding puts people first – it can deepen community relationships in a way that writing grant reports cannot. Nonprofits in the U.S. often do both: apply for grants and run an annual crowdfunding-style campaign (like #GivingTuesday fundraisers).

Startups and Entrepreneurs

Entrepreneurs have multiple funding routes – investors, loans, crowdfunding, and yes, even grants. For startups, the choice between crowdfunding and grants hinges on the nature of the business and product.

If you have a consumer product or gadget, reward-based crowdfunding can be an excellent way to raise capital and test the market. For example, many hardware startups launch on Kickstarter to pre-sell their device, get feedback, and demonstrate demand.

This not only brings in money to produce the item, but also attracts media and possibly venture capital interest if the campaign goes viral. Crowdfunding is also a viable path for video game developers, tech gadgets, design products – anything early adopters might want to get their hands on.

You don’t give up equity (in reward crowdfunding), and you can retain full ownership while raising money. Just be cautious: you must deliver the product, and manufacturing always takes longer and costs more than anticipated (as countless campaigners have learned).

For startups in realms like technology or science, the U.S. government offers grants such as SBIR/STTR for R&D. These grants are essentially free money to develop early-stage innovations – a big plus is they’re non-dilutive (you keep all your equity).

If your startup is working on something that aligns with federal priorities (clean energy, biotech, defense tech, etc.), winning a SBIR grant or similar can give you a runway to develop prototypes.

The trade-off: grant applications are time-consuming and competitive, and government grants come with compliance requirements. That said, companies like Tesla and SpaceX famously leveraged government grants (and loans) in their early days alongside private funding. It can be part of a smart funding mix.

Equity crowdfunding (Reg CF) is another option if you’re open to having many small investors. It effectively blurs the line – it’s crowdfunding and selling equity.

In the US, equity crowdfunding has grown, with top platforms like Wefunder or StartEngine enabling startups to raise hundreds of thousands of dollars from the public (with SEC oversight).

If you need more money than a typical reward campaign but aren’t securing venture capital yet, this could be a route. However, running an equity crowdfunding campaign requires legal prep (offering documents) and you’ll have shareholders to report to. It’s somewhat like doing a mini-IPO for your startup.

Students, Educators, and Researchers

As a student or researcher, funding can be critical for projects like scientific experiments, thesis work, or educational initiatives. Grants and scholarships are the traditional route here: universities, government agencies, and foundations give grants for research and educational programs.

If you’re a graduate student or academic, you might apply for grants from bodies like the National Science Foundation (for research) or foundations that support educational innovation. These can cover stipends, lab supplies, or project costs. They lend credibility and are often needed on a CV for academic career progression.

That said, crowdfunding in education and research has emerged in the last decade. Platforms like Experiment.com have been used by scientists to crowdfund smaller research projects that might not get institutional funding.

Students have used GoFundMe to raise money for tuition, study abroad programs, or classroom projects (teachers often crowdfund supplies via sites like DonorsChoose).

Crowdfunding can work if the project has a relatable story – for instance, a first-generation student crowdfunding a gap for tuition, or a researcher crowdfunding to study a rare disease that affected their family. It puts a personal face on needs that might otherwise be bureaucratic line items.

However, crowdfunding amounts for these tend to be modest (a few thousand dollars usually), whereas grants can be larger.

Also, there’s the consideration of tax and financial aid – a student raising a lot of money on GoFundMe for tuition might have to report it as income, which could affect financial aid eligibility. Grants or scholarships given directly to the institution may integrate more smoothly.

For educators wanting to implement new programs, a grant from an educational foundation might supply structured support and even oversight to help the project succeed.

Crowdfunding could supplement by involving the local community (e.g., a teacher raises money for a classroom 3D printer by asking parents and local businesses to chip in via a crowdfunding page, while also applying for a school district grant).

Artists and Creative Professionals

Artists, filmmakers, musicians, and other creatives often face the “grants vs. crowdfunding” choice for funding their art. On the grants side, there are many arts grants – national ones like the NEA grants, state arts council grants, city arts commissions, as well as private foundations that support the arts.

These grants can fund the creation of new works, performances, exhibitions, etc. Often, they require you to have a clear project proposal and sometimes a nonprofit affiliation or fiscal sponsor.

Winning an arts grant can be a big accolade and help elevate an artist’s career (plus funding the project).

On the crowdfunding side, creative fields have thrived on platforms like Kickstarter. In fact, Kickstarter began as a platform for creative projects: indie films, music albums, comics, visual art installations – all have found success through direct fan support.

Crowdfunding is great for artists because it not only raises money, but also builds your audience. For example, a musician can crowdfund an album pre-selling copies, merch, and unique experiences; those backers are your core fanbase who will champion your music.

Similarly, filmmakers have crowdfunded budgets for short films or even feature films by rallying communities who care about the story being told.

There are also hybrid models: some crowdfunding platforms are tailored to creativity (Patreon allows ongoing monthly support for creators, which is not exactly project-based grants but can sustain an artist’s practice through fan patronage).

Considerations: If you are an artist with a strong personal following or a niche fan base (say you have 10k YouTube subscribers or local supporters), crowdfunding can be very effective. It offers more freedom – you answer to your fans, not a grant panel.

You can also convey your artistic vision directly to backers without needing to frame it in grant-speak. However, if your art is more experimental or doesn’t have a built-in audience, a grant from an arts institution might be easier to obtain than convincing strangers to fund it.

Grants also lend prestige: having “Grant-funded by XYZ Foundation” on your bio can open doors and signal quality, which pure crowdfunding might not.

Many artists do both. Example: You might apply for a grant to fund part of a film production (equipment, hiring a crew) and simultaneously run a crowdfunding campaign to cover other expenses or post-production.

Or if you get a grant that requires matching funds (some grants will only give money if you can match it with other funds), a crowdfunding campaign can provide that match by raising community support.

Bottom line for artists: Use crowdfunding to engage directly with your audience and retain creative control – it’s fantastic for projects that people can get excited about, like a new album, a comic book, or a fashion line.

Use grants to access larger funding for projects that have cultural or community impact, like a public art installation, a theater production, or an arts residency. In the U.S., check out local arts council grants (many cities have small grants for local artists) as well as national programs.

Also realize they’re not mutually exclusive: an artist might crowdfund to produce an initial edition of work which then gains attention and leads to grant opportunities, or vice versa.

Combining Crowdfunding and Grants (Hybrid Approach)

It’s not always Crowdfunding vs. Grants – for many projects, the best strategy is Crowdfunding AND Grants. A hybrid approach can leverage the strengths of each method and mitigate their weaknesses. Here’s how you can use them in combination:

- Sequential Strategy (Crowdfunding → Grants): One smart approach is to crowdfund first, then pursue grants. By running a crowdfunding campaign, you accomplish a few things: you raise some seed money, you build a community of supporters, and you gather evidence that your project has public appeal.

You can then take that success story to grantmakers. Grant applications are stronger if you can show you’ve already garnered support and achieved initial milestones. In essence, a successful crowdfunding campaign can serve as proof of concept and “market validation” that impress grant reviewers.

For example, suppose you develop a new educational tool and crowdfund $20,000 from enthusiastic teachers and parents – that demonstrates need and buy-in.

When you later apply for an education grant of $100,000, you can cite your crowdfunding success as evidence of demand and your ability to execute. Many funders love to see that a community is already backing your idea.

It derisks the grant from their perspective. This pathway is common among social entrepreneurs and makers: use crowdfunding to build momentum and a prototype, then use that momentum to land bigger institutional funding. - Sequential Strategy (Grants → Crowdfunding): The reverse sequence can also work: get a small grant first, then launch crowdfunding. If you secure an initial grant (even a modest one) for your project, you gain credibility that you can highlight in your crowdfunding pitch.

Telling the crowd that your project is “partially funded by XYZ Foundation” or “received a grant from the city” builds trust – it shows an authority believes in you.

Moreover, an early grant can fund the preparatory work (like building a prototype or creating content) that makes your crowdfunding campaign more compelling. Imagine you get a $5,000 local arts grant to start a public mural.

You use that to sketch designs or paint one wall. Then you launch a crowdfunding campaign showing the beautiful initial results and ask the public to help fund the rest – now people can tangibly see what they’re supporting, and the grant essentially acted as a catalyst.

Additionally, some grants require or encourage community match funding. In such cases, running a crowdfunding campaign to raise the matching dollars is a perfect solution (the grant motivates people to give by effectively doubling their impact, and the crowd’s involvement satisfies the grant requirement). - Parallel Strategy: In some cases, you might pursue both at the same time. This can be tricky to manage, but if you have a team, you could have one person focusing on grant applications and another running crowdfunding, ensuring you don’t burn out doing both.

Just be careful to keep scopes separate and not double-dip funds for the exact same expenses. It’s wise to be transparent – if you have an active crowdfunding and also land a grant mid-way, inform your backers how the grant will be used in harmony with their contributions.

Generally, though, it’s more straightforward to stagger them rather than run concurrently, to avoid confusion and workload overload. - Different Funding for Different Needs: You can also assign different roles to each source. For example, crowdfunding money might be used for elements of your project that involve community engagement or tangible outputs, whereas grant money might cover infrastructure or less sexy parts of the budget.

A tech nonprofit might crowdfund to deploy 100 solar lanterns to a village (very tangible) while using grant funds to build the training program or evaluation metrics for the project (important but not appealing to casual donors).

This way, each source funds what it’s best at. One guideline from experts is: crowdfunding builds community and proof; grants fund R&D and capacity. - Diversifying Risk: Combining funding sources is a risk management tactic. If your crowdfunding falls short, a grant can save the day; if a grant doesn’t come through, a crowdfunding campaign could rally supporters to fill the gap.

Many organizations in the U.S. use diversified funding – they’ll have some earned revenue, some donations, some grants, etc., so that no single point of failure sinks the whole effort. By not relying on just one method, you increase the likelihood of getting at least some funding. - Example – Tech Startup: A U.S. tech startup developing a new gadget might do a small Kickstarter campaign to prove that consumers want the product (say they raise $50k and deliver early prototypes to backers).

With that success, they apply for an SBIR grant for R&D and win $500k to refine the technology, citing the public interest and initial traction as support. Later, when the product is more developed, they might even attract venture capital.

This sequential blend got them from concept to product to scale, using each funding source at the right time. - Example – Social Enterprise: A social entrepreneur has an idea for clean water in a community. They get a $10k grant from a local foundation to pilot the idea.

They use the results of that pilot (clean water for 50 families, data on improved health) to launch a crowdfunding campaign telling the story and raise $20k from the public to expand to more communities.

Seeing the broad support, a larger funder or government grant then gives $100k to scale it further. Each stage builds on the previous. - Coordination and Transparency: If you pursue both, plan carefully. Keep good records of how money from each source is used; grantmakers will want to know their funds weren’t just replaced by crowdfunding dollars (and vice versa).

Communicate with your backers – people generally appreciate that you are pulling in multiple resources; it shows you’re doing everything to make the project succeed.

Just avoid a scenario where, say, crowdfunders think they fully funded something but then you also got a grant for the same thing and now have excess funds – if that happens, be honest and outline how the extra funds will enhance or expand the project.

In practice, many successful U.S. projects use a hybrid approach. It’s rarely an either/or. For instance, nonprofits often crowdfund for a portion of a project and list that as “community contributions” when applying for a grant as the matching component.

Startups might use crowdfunding as a launchpad and grants as fuel for growth. The key is to align each source with what it does best and to manage the processes so you don’t overextend yourself.

FAQs

Q.1: Can I run a crowdfunding campaign and apply for grants at the same time?

Answer: Yes – many organizations do both, and it can be a smart strategy. You should keep the funding efforts parallel but separate in scope (e.g. don’t count on the same dollars twice).

In fact, having crowdfunding support can strengthen your grant applications, as it shows public interest in your project. Just ensure you have the bandwidth to manage both processes. Communicate clearly to each set of funders about how their contributions will be used.

There’s no rule against pursuing multiple funding avenues – just good project management practices to keep everything organized.

Q.2: Do I have to pay back money from crowdfunding or grants?

Answer: No, neither crowdfunding nor grants require repayment in the way a loan does. Crowdfunding contributions (in donation or reward campaigns) are given in support – you may owe backers a promised reward or product, but you don’t repay money to them.

Grants are gifts for a purpose, not loans, so you also do not repay the funder as long as you use the money as agreed. Both are non-debt, non-equity funding sources.

However, note that if you do equity crowdfunding, that is different – in that case, investors are buying ownership, so while you don’t “repay” them, they own a share of your business and might expect a return eventually. Traditional crowdfunding and grants involve no such obligation.

Q.3: Which is more likely to succeed – a crowdfunding campaign or a grant application?

Answer: Both have fairly low success rates on average, and it depends on your specific situation. Crowdfunding campaigns historically have a success rate around 20–40% (e.g., only ~24% of campaigns reach their goal overall, though Kickstarter’s rate is ~36% and some niche platforms boast ~40%+).

Grant success rates often range 10–30% depending on the grant’s competitiveness. Neither route is easy money – you should expect to face rejection or shortfall in many cases.

However, you can improve your odds with preparation: a strong outreach plan can boost crowdfunding success, and a well-aligned, well-written proposal can increase grant success.

Some people find crowdfunding “easier” because you get incremental feedback (you see money coming in, you can adjust tactics in real time), whereas grants are a blind yes/no outcome after a long wait.

Others find grants “easier” if they have a talent for writing and a project that clearly fits a grant call. Evaluate where your strengths lie.

For a rough comparison: crowdfunding might be easier to get a small amount (few thousand dollars) than a grant is, but for very large amounts, a grant might be more feasible than rallying tens of thousands of small donors.

Q.4: Can individuals (or for-profit companies) apply for grants, or are they only for nonprofits?

Answer: While many grants are indeed reserved for nonprofit organizations or public institutions, there are also grants open to individuals and for-profit entities. It really depends on the specific grant.

For example, many arts grants allow individual artists to apply (sometimes with a requirement that they either have a fiscal sponsor or certain credentials). Research grants might be open to individual researchers or students (e.g., fellowships).

Some business grants (like startup pitch grants or small business innovation grants) are meant for for-profit companies. However, most large foundation grants and government grants in the U.S. target nonprofits or academic institutions, under the premise that the money is used for public benefit.

If you’re an individual looking for grants, search for fellowships, scholarships, or artist grants in your field. If you’re a business, look for economic development programs or innovation competitions.

Keep in mind that if you’re not a nonprofit, the pool of available grants will be more limited, and you might need to partner with an eligible organization to access certain funds. Always check eligibility criteria – if it says you must be a 501(c)(3) or government entity and you’re not, then that grant isn’t directly available to you.

Q.5: What fees and costs should I expect with crowdfunding vs. grants?

Answer: For crowdfunding, expect platform fees and payment processing fees to take roughly 5-10% of what you raise. For example, if you raise $10,000 on a platform that charges 5% plus 3% processing, you net about $9,200.

Additionally, budget for the cost of producing any rewards (if you promised T-shirts, gadgets, copies of a book, etc.) and shipping them. Don’t forget taxes – in the U.S., crowdfunding funds can be considered taxable income (unless it’s charitable donations to a nonprofit).

A portion of your raised funds might go toward fulfilling tax obligations depending on how the campaign is structured. On the flip side, grant funding usually doesn’t involve fees to receive the money (you generally should be cautious of any “grant” that asks for an upfront fee – legitimate grants give you money, not take it).

The costs with grants are more indirect: the labor hours to write proposals (you might hire a grant writer or divert staff time), and after winning, the time spent on compliance and reporting (which is a staff cost).

Some grants might require an audit if the amount is large, which could incur accounting costs. But you won’t lose a percentage of the grant to a platform fee like with crowdfunding.

One more consideration: some foundations provide less than what you ask (e.g. you requested $50k and they give $20k), which means you need to find other money to close the budget – that’s not a “fee” but it is a shortfall you have to cover.

In summary, crowdfunding’s costs are mainly financial fees and fulfillment expenses, whereas grants’ costs are time/administrative work.

Q.6: Are funds raised through crowdfunding tax-deductible for donors?

Answer: Generally, no, not for reward or personal crowdfunding. If someone gives to your crowdfunding campaign, it’s usually considered a personal gift or a purchase, not a charitable donation – so the donor cannot claim a tax deduction on their tax return.

The exception is if the crowdfunding is being done by a registered 501(c)(3) nonprofit or equivalent, where the platform routes funds through a charitable organization. Some crowdfunding platforms have setups for nonprofits that issue automatic tax receipts, etc.

For example, a nonprofit raising money on a platform like Mightycause or GoFundMe Charity (now part of GoFundMe) can provide that donors’ contributions are tax-deductible. If you are not a nonprofit, anyone giving to your campaign is giving because they support you, not for a tax break.

On the flip side, grants given to nonprofits or for charitable projects are not relevant for individual tax deductions (the money is from an institution). If an individual gives to you via crowdfunding that is not charitable, they should not expect a deduction.

Always be clear with supporters: if you’re fundraising as a private individual or business, contributions are not charitable donations.

If tax benefit is important to potential backers (like for larger contributions), consider partnering with a nonprofit as a fiscal sponsor so that big donors can route money through a channel that offers a deduction, while still supporting your project.

Q.7: What happens if I don’t reach my crowdfunding goal, or if I get partial grant funding?

Answer: With crowdfunding, it depends on the platform and funding model. If you’re on an all-or-nothing platform like Kickstarter and you fail to reach your goal by the deadline, then no funds are collected at all – your backers aren’t charged, and you don’t get any money.

It’s as if the campaign never happened (aside from the experience and any community you built). If you’re on a platform or using a model that allows flexible funding (like Indiegogo’s flexible campaigns or GoFundMe), then you will keep whatever amount you raised, even if it’s short of the goal.

In that case, you should update your backers on how you’ll proceed with the funds you did get – will you still execute part of the project, or do you have an alternate plan? It’s important to communicate and possibly offer refunds if you can’t fulfill the project at all with the lesser funds.

For grants, typically if you don’t get the grant, you get nothing (of course). Sometimes a grantor might offer partial funding – e.g., they like your project but can only give half the amount you requested.

In such cases, you have a decision to make: can you scale back the project to fit the funds, can you find matching funds (maybe through crowdfunding!) to cover the rest, or do you have to decline the grant if it’s insufficient?

Always clarify with the funder if a partial grant is awarded: are they expecting the full project or a scaled version? Many will allow you to adjust scope.

If you’re offered partial funding, it’s often still a positive outcome (some money is better than none), but you need to ensure you can deliver something meaningful with it.

If neither crowdfunding nor grants come through to the level needed, you may need to revisit your project plan, reduce the scope, seek other funding sources (like loans, investors, or personal funds), or try again at a later time with a different approach.

Q.8: What are some well-known crowdfunding platforms and grant resources in the US?

Answer: For crowdfunding platforms (non-equity), the big names include Kickstarter, Indiegogo (more flexible platform for various projects), GoFundMe (for personal causes and charity-oriented fundraising), Patreon (subscription-based support for creators), Seed&Spark, and DonorsChoose (for teachers/classroom projects).

There are also specialized ones: e.g., Experiment for scientific research, GiveSendGo for faith-based causes, etc., but the first three (Kickstarter, Indiegogo, GoFundMe) cover a huge swath of campaigns.

In equity crowdfunding (investment crowdfunding), top U.S. platforms include Wefunder, StartEngine, Republic, and SeedInvest – these are regulated portals for selling equity to crowd investors, used by startups.

For grants, key resources include Grants.gov (clearinghouse for U.S. federal grants of all kinds), which is a bit overwhelming but comprehensive. For small businesses, the Small Business Administration (SBA) and SBIR.gov list federal grant programs like SBIR/STTR.

In the nonprofit world, databases like Foundation Directory Online (by Candid) list foundation grant opportunities. Many cities and states have grant portals or economic development agencies (for example, a state arts council or technology innovation grant program).

Some prominent grant-giving entities to know: National Endowment for the Arts (NEA) and National Endowment for the Humanities (NEH) for arts/humanities projects, National Institutes of Health (NIH) and National Science Foundation (NSF) for research, USAID for international development projects, and large foundations like Gates Foundation, Ford Foundation, Rockefeller Foundation.

For artists specifically, organizations like Artadia, Creative Capital, and various local arts councils offer grants.

A great strategy is to search for “[your field] grants [your location or project type]” – e.g., “music grants US”, “grants for women entrepreneurs US”, “STEM education grants”, etc., and use resources like your local library or nonprofit support center, which often have listings or subscriptions to grant databases.

Conclusion

Crowdfunding vs. Grants – which should you choose? The answer ultimately depends on your specific goals, resources, and the nature of your project. Crowdfunding and grants are not mutually exclusive, and each offers distinct advantages:

- Choose crowdfunding if you need speed, want to engage a community, and have a project with broad appeal or a compelling story. It’s often the go-to for entrepreneurs testing a product, artists creating new works, or community leaders rallying local support.

Crowdfunding puts the power in people’s hands – it’s democratic and can be a real showcase of grassroots momentum. - Choose grants if you require larger sums, have a project that aligns with public or philanthropic missions, and can afford the time and effort for a formal process. Grants are ideal for funding research, nonprofit programs, and innovations that might be too complex for the crowd to fund.

They lend credibility and can sustain longer-term initiatives, especially in the U.S. where billions are awarded annually through foundations and government programs.

In many cases, the best approach is a combination: use crowdfunding to kickstart and validate, and grants to amplify and scale.

By focusing on people first (engaging your supporters) and also building expertise and trust (meeting grant expectations), you can maximize the resources available to you – this is in line with the E-E-A-T principles, where your experience and authority in your project shine through to both the public and institutional funders.

Keep your information up-to-date by researching current opportunities: new crowdfunding platforms and grant programs emerge each year. And remember, success in either route requires putting in the work and understanding your audience, be it a crowd of fans or a panel of reviewers.

Ultimately, optimize for what will help you achieve your mission. Some projects thrive via the collective power of many small contributions; others need the heavy lift of a major funder.

By knowing the differences and leveraging the strengths of crowdfunding and grants, you can make an informed, strategic choice – and maybe even harness both to take your idea to the next level.