How to Avoid Predatory Business Loans

Predatory lenders can trap businesses with hidden fees and high interest. Reading all terms and understanding loan offers is key. Small business owners and startups must learn to avoid predatory business loans that can drain their capital.

Predatory lending uses exploitative loan terms that unfairly benefit the lender and harm the borrower. Such loans often carry hidden fees, extremely high interest rates (sometimes triple digits), or balloon payments that small businesses cannot afford.

This comprehensive guide explains predatory loan examples, warning signs of predatory lending, how to steer clear of scams, what to do if you’re trapped in a bad loan, and the current U.S. laws that can protect businesses.

Understanding Predatory Business Loans

Predatory business loans are financing offers with unfair, deceptive, or abusive terms. In practice, predatory lending “benefits the lender and ignores or hinders the borrower’s ability to repay”. Predatory lenders often charge excessive interest and fees and hide costs in fine print.

For example, industry observers have noted loans with annual percentage rates (APRs) in the “high double or triple digits,” and monthly payments sometimes double what the business can actually afford. These tactics trap borrowers in a debt cycle that stunts the business’s growth and eats away profit.

Small businesses are particularly vulnerable because they lack the strong consumer protections that shield personal borrowers. In fact, regulatory experts point out that commercial loans are not subject to the same disclosure rules (like the Truth in Lending Act) that protect consumer loans.

As a result, some online or specialty lenders use aggressive marketing and complex loan structures to take advantage of businesses that urgently need cash. Recognizing the nature of predatory loans — and knowing the laws in your state — is the first step in avoiding them.

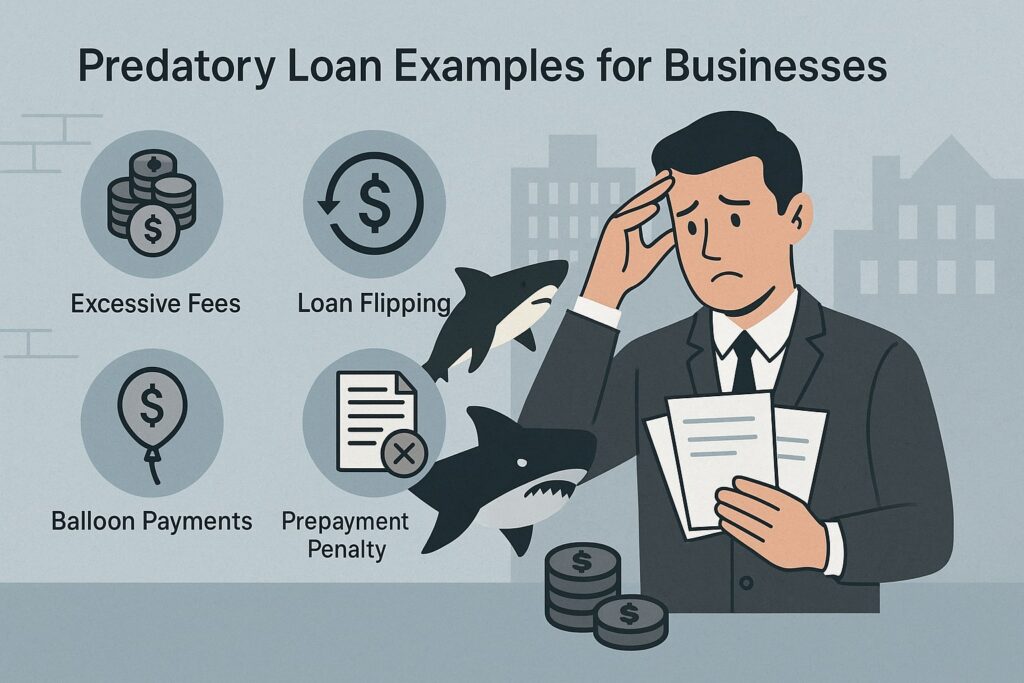

Predatory Loan Examples for Businesses

Predatory lenders use many tactics. Some of the most common predatory business loan examples include:

- Merchant Cash Advances (MCAs): Often called “payday loans for businesses,” MCAs give a lump sum in exchange for a fixed percentage of future sales. Repayments occur via daily or weekly withdrawals from the business’s account.

While MCAs seem convenient, they frequently carry effective APRs above 100% (sometimes exceeding 300%). In one law firm analysis, lenders disguised these advances as “sales” of receivables to skirt usury laws, even though the borrower has a fixed payment schedule and debt burden.

These contracts often include personal guarantees and broad liens on business assets, meaning the owner risks losing personal property if payments lapse. - Short-Term Bridge or Cash-Flow Loans: Some alternative lenders advertise quick bridge loans or inventory financing with no credit check and fast approval.

However, they may hide extra charges (for things like loan origination or mandatory insurance) and charge extremely high rates.

For example, digital fintech lenders rapidly emerged offering business loans at APRs in the high double-digits or more. Borrowers may only realize the true cost after signing away rights to refinance or prepay. - Confession-of-Judgment Terms: Certain business loans (especially MCAs) include a confession-of-judgment clause. By signing this, a borrower agrees that the lender can obtain an uncontested court judgment against them if they default.

This effectively waives the borrower’s right to challenge the debt. Predatory lenders have historically misused these clauses to seize collateral (or even a business owner’s personal assets) without notice. (Notably, Virginia’s new law now prohibits confession-of-judgment provisions in merchant cash advance agreements.) - Excessive or Hidden Fees: Predatory loans often bury junk fees in the fine print. These can include large prepayment penalties, weekly processing fees, or forced add-ons like credit-insurance products.

Such fees are typically not reflected in the advertised APR. The total cost can far exceed what a borrower expects. For example, lenders may tack on unused line fees or unauthorized charges each month, inflating the loan cost. If a lender fails to clearly disclose all costs, it is a red flag. - Loan Flipping: Some lenders offer to refinance a borrower’s loan immediately after origination, claiming it will improve terms. In reality, each refinance generates new origination fees and interest points, leaving the borrower deeper in debt.

This “flipping” traps businesses in an escalating debt burden. It’s a classic predatory move: the lender profits from fees, not the underlying business success.

By contrast, legitimate business loans (such as standard bank or SBA loans) disclose APRs and fees upfront and align repayment schedules with the borrower’s cash flow. If a loan offer includes one or more of the red flags above, it should be considered suspect.

Signs of Predatory Business Lending

Being alert to warning signs can help you get out of a predatory loan before it’s too late. Key red flags include:

- No Credit Check or Guaranteed Approval: Predatory lenders often promise approval “regardless of credit” to lure desperate borrowers. Legitimate lenders review credit and finances to ensure repayment ability. If a lender insists on giving you money without scrutiny, be suspicious.

- Extremely High Interest Rates: Interest that far exceeds typical bank or credit-card rates is a hallmark of predatory loans. An advertised rate that seems too high to be true probably is.

It’s wise to calculate the APR (total interest and fees annualized) and compare it to standard market rates. Triple-digit APRs (100%+) are almost always predatory. - Large Balloon Payments: If a loan has unusually low monthly payments but a very large lump-sum due at the end, it may be hiding the true cost.

Balloon payments can make loans look affordable at first, then suddenly unaffordable. Predatory lenders use them to disguise high costs. Never accept a loan where you do not clearly understand and can afford the final payment. - Excessive Fees and Add-Ons: Watch out for mandatory add-ons, like insurance you didn’t request or unexplained origination fees.

Predatory lenders sneak in these junk fees to pad their profit. If your loan documents show large fees but you didn’t agree to them explicitly, ask questions. A good lender should be transparent about all costs. - Harsh Terms (Prepayment Penalties, Confessions, Personal Recourse): Some predatory agreements penalize early payoff (so you can’t refinance to a better loan), require onerous personal guarantees, or allow the lender to sue you in an unfavorable forum.

For example, New York law explicitly prohibits confession-of-judgment clauses in business financing because they strip borrowers of legal rights. Any clause that feels one-sided (benefiting only the lender) is suspect. - High-Pressure Sales Tactics: Predatory lenders often pressure you to sign quickly, use aggressive marketing calls, or refuse to provide a human point of contact.

Offers that push you to decide right now usually want you to act before you notice the bad terms. Legitimate lenders will give you time to review contracts and ask questions.

If you see any of these signs in a loan offer, stop and reassess. Walk away and seek other funding. Filling out an application is risk-free, but signing a predatory contract can be disastrous.

How to Avoid Predatory Business Loans

To stay safe, follow these best practices when seeking business financing:

- Research and Compare Options: Shop around among banks, credit unions, and reputable online lenders. Compare APRs, terms, and fees for any loan offer.

Ask multiple lenders for Term Sheets or quotes and compare the total cost. If one offer seems markedly worse than others (higher rate or hidden fees), avoid it. - Use Trusted Lenders: Favor established institutions or alternative lenders that participate in the Responsible Business Lending Coalition (RBLC) or follow ethical guidelines (such as the Small Business Borrowers’ Bill of Rights).

Community banks, credit unions, and certified Small Business Administration (SBA) lenders typically have transparent, regulated terms.

The SBA’s own loan programs (like 7(a) loans) have clear disclosures and reasonable rates – qualifying for an SBA loan is a strong safeguard against predatory terms. - Read Every Document Carefully: Never sign anything without reading it fully. Check that all interest rates and fees are clearly stated. Legitimate lenders will disclose the APR in writing.

If a lender is vague or reluctant to give you detailed paperwork, take your business elsewhere. Understanding the fine print (late fees, payment schedule, balloon, collateral) is crucial. - Ask Questions: A reputable lender should willingly answer your questions. Ask for examples or a full amortization schedule. If details seem evasive, that’s a red flag. Confirm whether any optional products (like payment protection insurance) are truly optional.

- Check References and Reviews: Look up the lender online. See if it has reviews on the Better Business Bureau or any complaints filed with the state Attorney General or CFPB. Be wary if you find repeated customer warnings or unresolved issues.

- Consider Professional Guidance: Especially for new or growing businesses, consider working with a business credit advisor or a financial counselor.

Nonprofit organizations (like local Small Business Development Centers) can review loan offers with you. They may recognize predatory structures that you might miss alone. - Leverage Relationships: If you have a solid banking relationship (e.g., with your commercial banker), start there. Even if you don’t immediately qualify for a bank loan, your banker might suggest alternative credit solutions that are safer.

By being diligent—asking for written disclosures, comparing APRs, and avoiding deals that sound “too good to be true”—you greatly reduce the chance of falling into a predatory loan trap. Remember: trust your instincts. If something feels wrong, pause and consult with someone.

Getting Out of a Predatory Loan

If you realize you’ve signed a predatory loan, act quickly to mitigate damage. Possible steps include:

- Consult Financial or Legal Help: Contact a certified credit counselor or business financial advisor. They can help you understand your rights and restructuring options.

A business attorney or your state’s small business development center may also provide guidance on negotiating or disputing unfair terms. - Refinance with a Reputable Lender: If your credit and cash flow allow, look for a new loan (perhaps through an SBA 7(a) or a bank line of credit) to pay off the predatory debt.

Lower-rate refinancing can break the debt cycle. (Make sure the new loan truly has better terms and no hidden catch.) - Renegotiate with the Lender: It’s rare, but sometimes a predatory lender may agree to modify the loan if you explain the situation.

You could request removal of a balloon payment or reduction of an outrageous interest rate. Put any agreement in writing. - Consolidate or Personal Loan: As a last resort, consolidating your business debt into a personal loan with a lower rate might help (if you qualify). Debt.org advises consolidating predatory loans into a single lower-rate loan and diligently paying it off.

- Report and Demand Relief: File a complaint with the Consumer Financial Protection Bureau (CFPB) and your state Attorney General’s office.

If a lender has clearly broken the law (fraud, unauthorized charges, unfair collection), regulators or a court can sometimes void illegal terms. In past cases, courts have vacated judgments obtained through illegal “confessions” and ordered refunds. - Reduce Expenses and Boost Cash Flow: While addressing the loan, tighten your budget to free up cash for payments. Sell any nonessential assets or negotiate longer terms with vendors to ease cash flow.

- Consider Restructuring or Bankruptcy: In extreme cases where the debt is unmanageable, talk to a bankruptcy attorney about business restructuring or Chapter 7/11. This is a last resort, but it can eliminate predatory debt and stop aggressive collections.

The key is to act early. The sooner you try to restructure or refinance, the less time interest and fees have to accumulate. Seek help from professionals or non-profits – they have seen similar situations and can recommend a plan to get you back on track.

Legal Protections and Regulations

In the U.S., small businesses do have some recourse, but the landscape is patchy. Unlike consumer loans, most business financing falls outside strict federal rules like the Truth in Lending Act (TILA) or Equal Credit Opportunity Act.

Congress has left much oversight to the states. In recent years, states have begun enacting laws to curb predatory lending to businesses. Notably:

| State | Law/Regulation (Date) | Key Requirements | Effective Date |

|---|---|---|---|

| California | Commercial Financing Disclosure Law (SB 1235, 2018) | Requires lenders to disclose total funds, total dollar cost, repayment term, payment schedule, prepayment terms, and an APR equivalent for any business loan under $500k | Dec 9, 2022 |

| Utah | Commercial Financing Registration & Disclosure Act (2022) | Commercial lenders must register with state and disclose funds provided, total repayment, payment schedule, APR (as applicable), and fees for loans ≤ $1M | Jan 1, 2023 |

| Virginia | HB 1027: Merchant Cash Advance Registration (2022) | Requires MCA providers to register with state, disclose key terms (except APR not required), and bans confession-of-judgment clauses. Puts dispute rules (e.g., local arbitration) | July 1, 2022 |

| New York | Commercial Financing Disclosure Law (2020) | Once fully implemented, will require clear APR disclosures and loan terms for commercial loans up to $2.5M, aligning with CA standards | Pending final rules |

These laws compel transparency: you should receive a clear breakdown of your loan’s cost (much like consumer loans do). The CFPB has even weighed in, stating these state rules are not preempted by federal law because they target commercial (non-consumer) financing.

Aside from state laws, the Federal Trade Commission (FTC) and state Attorneys General can act against outright illegal practices. For example, in 2022 the FTC banned two firms and ordered them to redress over $675,000, after finding they had deceived small businesses and unlawfully used confessions of judgment.

Similarly, misleading debt collection (threatening violence, etc.) is already illegal under general consumer protection laws.

It’s also important to check your state’s usury laws. For instance, New York caps business loan interest at 25% APR. Many MCAs hide well above that rate, which courts have challenged.

If a loan is structured as a disguised loan with interest above the cap, it may be voidable under state law. (In fact, lenders often try to claim payments are “fees” to evade usury limits — a tactic you should question.)

Finally, while the federal SBA and the Treasury have no broad anti-predatory mandate for small businesses, programs like the CARES Act emergency loans during COVID-19 showed the government can intervene to provide fair credit.

Business owners should monitor new rules or CFPB actions; for example, Section 1071 of Dodd-Frank (currently under study) could eventually increase transparency in small business lending.

In sum, although predatory loans aren’t automatically illegal, many predatory features are. Hidden fees, lies about loan costs, unauthorized asset seizures and usury violations are all prohibited by law.

By comparing your loan to the disclosures required by these laws (and refusing deals that violate them), you ensure lenders stick to legal, honest lending.

Are Predatory Loans Illegal?

Predatory loans occupy a gray legal area. As Business Insider notes, “While predatory lending is unethical and exploitative, it’s not always technically illegal.”. That said, specific practices are illegal.

If a lender commits fraud (misrepresenting rates or fees) or violates an applicable law (like state usury caps or ban on confession clauses), the borrower can sue or report them.

For example, charging an APR above a state’s legal limit or adding undisclosed fees can violate state lending laws. Likewise, dishonest debt collection tactics or identity theft are federal crimes.

So: predatory lending as a concept isn’t banned (unlike outright loan sharking in criminal statutes), but many predatory features cross legal lines.

If you suspect illegality (for example, a lender threatened violence, filed an unauthorized lien, or lied on the loan documents), contact a lawyer or regulators immediately. You could get the loan voided or have judgments overturned, as happened in the FTC’s recent cash advance cases.

In practice, avoiding predatory loans is your best protection. But if you’re already caught in one, knowing the law helps you find remedies (like rescission, refund of fees, or debt adjustment under bankruptcy).

FAQs

Q.1: What is a predatory business loan?

Answer: A predatory business loan is one with unfair or abusive terms that unduly enrich the lender. This includes extremely high interest, excessive fees, or opaque terms that make repayment impossible.

In other words, these loans “benefit the lender and ignore or hinder the borrower’s ability to repay”. Predatory loans prey on urgency or desperation and often exploit legal loopholes to trap businesses.

Q.2: Can you give examples of predatory loans?

Answer: Yes. For instance, merchant cash advances are often predatory: businesses get cash upfront and agree to let the lender pull money directly from their accounts until paid off. Many MCAs have effective APRs over 100%, despite small stated “factor rates”.

Other examples include very short-term “bridge” loans with undisclosed fees or “rolling” unpaid debt (like some payday-style loans). Confession-of-judgment clauses in loan contracts are a predatory feature (recently banned in VA).

In general, any loan where the bulk of the cost is hidden from you — signaled by hidden fees, non-negotiable add-ons, or one-sided clauses — is considered predatory.

Q.3: How can I avoid getting stuck with a predatory loan?

Answer: Always research lenders and compare offers. Never take the first approval without exploring bank loans, SBA loans, or credit union loans. Read all paperwork; look for the APR and ask the lender to explain all fees.

If anything is unclear or seems unfair, walk away. Check if the lender is reputable – for example, see if it’s reviewed positively on the BBB or if they’ve endorsed any small business lending standards.

Working with a business finance advisor or attending a small business seminar can also help you learn to spot scams. In short: be wary of “too good to be true” offers, insist on full disclosure of terms, and take your time to compare safer financing alternatives.

Q.4: What should I do if I’m in a predatory loan?

Answer: First, don’t panic. Explore options: refinancing with a bank or SBA loan can replace the bad loan with fairer terms. Contact a business credit counselor or attorney to review the contract – they might find violations (e.g. undisclosed fees or illegal clauses) you can challenge.

You can also negotiate with the lender for better terms. If needed, file complaints with the CFPB and your state’s Department of Financial Institutions – in some cases, regulators have helped cancel illegal debt terms.

Meanwhile, tighten your budget to stay current on payments. If the debt is overwhelming, consult a bankruptcy attorney about restructuring or other options.

Q.5: Are predatory loans illegal?

Answer: Not always by definition, but many predatory practices are illegal. Simply charging a lot of interest isn’t illegal unless it violates state usury caps or disclosure laws. However, outright deceit (like lying about loan terms) and certain clauses (like hidden security interests) are illegal.

In fact, federal regulators and state attorneys have banned specific practices: the FTC recently outlawed certain MCA providers for using deceptive marketing and illegal collection tactics. As noted, some states have set strict APR limits (e.g. 25% in NY) or prohibited confession-of-judgment contracts.

Conclusion

Predatory business loans can cripple even a thriving company. The key to safety is knowledge and vigilance: understand common predatory tactics (exorbitant APRs, hidden fees, balloon payments, confession clauses, etc.), and never ignore warning signs.

Always read contracts fully and insist on transparent APR disclosures. Use SBA or bank loans when possible, and seek financing help from reputable advisors if needed.

Thanks to recent laws and enforcement actions, some abuses are being curtailed. Yet it remains up to each business owner to do due diligence.

By learning how to avoid predatory business loans and what to do if trapped, you protect your business’s finances and future. When in doubt, pause and seek second opinions – it could save your business from disaster.