How to Write a Funding Proposal That Attracts Investors

Crafting a funding proposal that captures the attention of investors is one of the most important steps for any entrepreneur or business owner. Whether you are running a startup, scaling a small business, or expanding into new markets, your proposal serves as the bridge between your vision and the financial support you need.

Investors are inundated with pitches daily, so your proposal must stand out as compelling, professional, and strategically sound. A great funding proposal is not just about stating how much money you need.

It must demonstrate your credibility, highlight your business’s potential, and show investors how they will gain value from supporting you. The structure, language, and presentation all play critical roles in convincing investors to take the leap of faith with your business.

This guide will provide a step-by-step roadmap to writing an effective funding proposal, explain what investors are really looking for, and offer best practices to maximize your chances of success.

Understanding the Purpose of a Funding Proposal

At its core, a funding proposal is a persuasive document. Its purpose is to convince potential investors, lenders, or grant committees that your business idea or project is worthy of financial support. Many entrepreneurs mistakenly believe the proposal is just a request for money.

In reality, it is more of a business case—an evidence-based argument that shows your company is not only viable but also profitable and worth the risk.

A funding proposal typically answers three crucial questions:

- What problem does your business solve?

- How will you use the funding to achieve measurable growth?

- What return on investment (ROI) can backers expect?

Investors are fundamentally risk managers. They know most startups fail within the first few years, so they look for clarity, feasibility, and trustworthiness in proposals. A well-prepared funding proposal gives them confidence that your business is organized, has done its homework, and understands the market.

Moreover, proposals serve as a relationship-building tool. Even if your request is not approved immediately, a strong proposal can keep investors interested for future opportunities. It shows professionalism, discipline, and vision—qualities investors value highly.

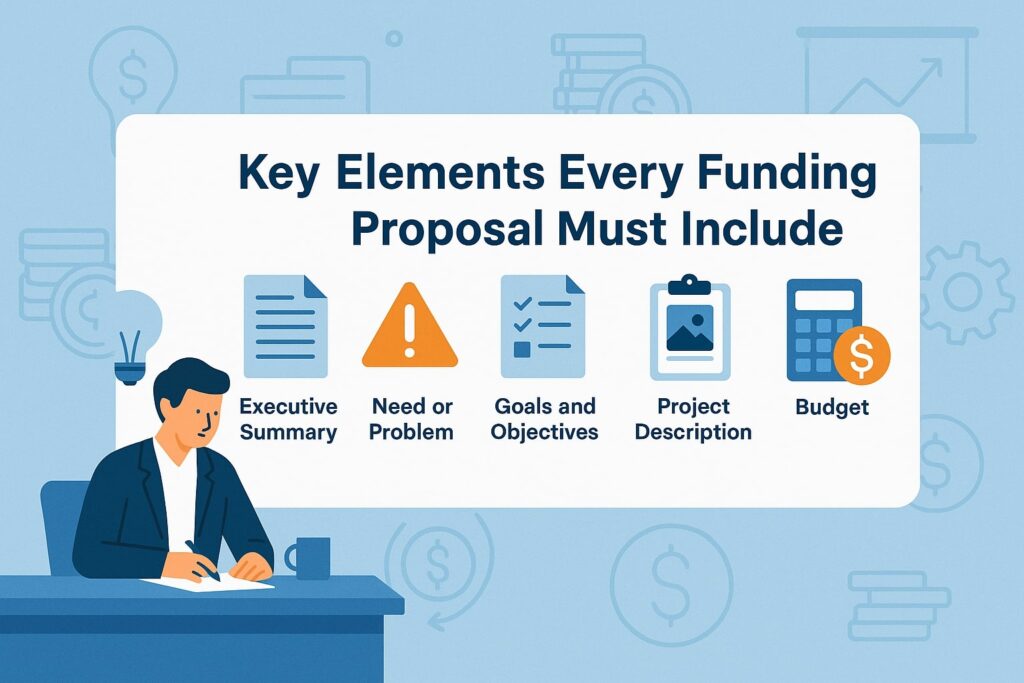

Key Elements Every Funding Proposal Must Include

When writing a funding proposal, structure is everything. Missing or poorly executed sections can make your proposal appear rushed or incomplete, no matter how great your idea is. A comprehensive proposal should include:

1. Executive Summary

This is the “elevator pitch on paper.” It condenses your entire proposal into a 1–2 page snapshot, summarizing the business model, funding needs, and expected returns. Think of it as the hook that determines whether investors will read further.

2. Business Overview

This section outlines your company’s history, vision, and mission. It also highlights your legal structure, ownership, and team background. Investors want to know who is behind the idea and whether they are competent to execute it.

3. Market Analysis

Without proof of demand, your business idea is just a theory. This section should include industry insights, target audience demographics, competitor analysis, and market trends. Investors want evidence that you understand your market and have carved out a niche.

4. Products or Services

Explain what you are offering and what makes it unique. Highlight value propositions, competitive advantages, and scalability. Investors want to know how your product solves a problem and why customers would choose it over alternatives.

5. Marketing and Sales Strategy

Here you show how you will attract and retain customers. Discuss distribution channels, pricing models, sales funnels, advertising campaigns, and customer engagement strategies.

6. Operational Plan

Detail the infrastructure, technology, suppliers, logistics, and human resources required to run the business. This reassures investors that you’ve considered practical implementation.

7. Financial Projections

Arguably the most scrutinized section. Provide realistic income statements, cash flow forecasts, and balance sheets for at least three to five years. Break down how much funding you need, how it will be allocated, and what returns investors can expect.

8. Funding Request

Be specific about the amount of capital you are seeking, the type of funding (equity, debt, convertible notes), and the proposed terms.

9. Risk Analysis and Mitigation

Show that you’ve identified potential risks and have strategies to minimize them. Investors appreciate honesty and foresight.

10. Appendices

Include additional materials such as charts, resumes, legal documents, product mockups, or patents.

Each of these elements not only provides information but also tells a story of preparedness. Skipping any may leave investors with unanswered questions—and unanswered questions usually mean rejection.

Writing an Executive Summary That Hooks Investors

The executive summary is the most critical part of your funding proposal. In many cases, investors read only this section to decide if they want to continue reviewing the document. If your summary is vague, overly complex, or uninspiring, the rest of your proposal may never be read.

A strong executive summary should:

- State your funding goal clearly – e.g., “We are seeking $500,000 in seed funding to expand our SaaS platform.”

- Highlight your value proposition – what makes your business model profitable and different from competitors.

- Introduce your team briefly – showcase why your leadership is capable.

- Summarize market potential – a snapshot of demand and scalability.

- Project investor returns – briefly mention expected ROI or growth.

Avoid stuffing too much data into the summary. Instead, focus on clarity, impact, and persuasion. Use plain language that even someone outside your industry could understand.

For example:

Instead of writing, “Our company leverages machine learning algorithms for predictive analytics in dynamic market environments,” you might say: “We help businesses forecast sales more accurately using AI tools, reducing losses and improving profits.”

Keep it concise, engaging, and easy to grasp. Remember: the executive summary is your proposal’s handshake—firm, confident, and memorable.

Crafting a Business Overview That Builds Credibility

While the executive summary focuses on vision and numbers, the business overview humanizes your proposal. Investors want to know the people behind the idea. A company with a strong team and clear values can often secure funding even if its idea is still in early stages.

Your business overview should cover:

- Company background – How and why was it founded?

- Mission and vision – What drives your company?

- Leadership and team – Who are the founders and key personnel?

- Ownership and legal structure – Is it an LLC, C-Corp, or partnership?

- Past milestones – Revenue growth, awards, or customer adoption metrics.

This section establishes trust. Investors are essentially betting on you as much as your business model. They want to feel confident that you can deliver results under pressure. Highlight prior successes, transferable skills, and industry experience.

If your business is a startup without a track record, focus on your team’s expertise and strategic plan. Use storytelling to show your passion and resilience—two traits investors highly value.

Market Analysis: Proving Demand and Scalability

No matter how brilliant your idea is, investors will not support it unless there is proven demand. Market analysis demonstrates that your business is rooted in reality, not just enthusiasm.

A compelling market analysis includes:

- Industry Overview – current size, trends, growth rate.

- Target Audience – demographics, psychographics, buying habits.

- Competitive Landscape – who are your rivals, and what differentiates you?

- Market Gaps – unmet needs your business addresses.

- Scalability – can the business grow regionally, nationally, or globally?

For example, if you’re proposing a new fitness app, you should include statistics on the health tech industry, customer segments (e.g., millennials, professionals), competitor apps, and what unique features you offer (personalized AI coaching, cheaper pricing, etc.).

Investors want to see data-backed claims. Use surveys, industry reports, case studies, and financial statistics. Avoid assumptions without evidence.

This section reassures investors that there is a clear path to profitability, and your business isn’t solving a problem no one actually has.

Financial Projections and Funding Requests

Numbers are the language of investors. While vision and creativity matter, financial clarity seals the deal. Your financial section must be realistic, detailed, and supported by assumptions.

Include:

- Revenue Projections – monthly or yearly income growth.

- Expense Breakdown – operating costs, marketing budgets, payroll.

- Profit Margins – expected net income.

- Cash Flow Forecasts – inflows and outflows to ensure liquidity.

- Break-even Analysis – when the business will cover costs and turn profit.

When making your funding request:

- Be specific: “We are seeking $750,000 in Series A funding.”

- Explain allocation: “40% for product development, 30% for marketing, 20% for hiring, 10% for legal and operations.”

- Offer terms: equity percentage, repayment structure, or convertible notes.

Investors will scrutinize this section. Inflated numbers or vague justifications can destroy credibility. Instead, present conservative yet optimistic projections. Show how the requested funds will fuel measurable growth and lead to attractive returns.

Common Mistakes to Avoid in Funding Proposals

Even strong business ideas fail to secure funding because of avoidable mistakes. Some common errors include:

- Overly optimistic projections without supporting data.

- Ignoring competition and assuming “we have no rivals.”

- Poor presentation with disorganized formatting or typos.

- Failing to highlight ROI for investors.

- Overloading with jargon instead of plain, persuasive language.

- Not customizing proposals for specific investors.

Avoid these by revising carefully, seeking feedback, and tailoring each proposal to the audience. Remember: your proposal is not just a document—it’s a reflection of your professionalism.

FAQs

Q1. How long should a funding proposal be?

Answer: A funding proposal’s length depends on the complexity of the project and investor expectations. On average, proposals range between 15 to 30 pages. However, quality is more important than quantity. A concise, well-structured proposal is more effective than a bloated one full of unnecessary details.

If you’re pitching venture capitalists, they may prefer shorter proposals supported by a detailed pitch deck. On the other hand, grant committees often expect more extensive documents. Tailor the length to the audience, industry, and funding type. What matters is that your proposal answers all key questions without overwhelming readers.

Q2. What’s the difference between a business plan and a funding proposal?

Answer: A business plan is a comprehensive roadmap for running your company, while a funding proposal is a targeted document designed to secure financial support. Business plans are broader, covering all aspects of operations, while funding proposals zoom in on investment needs, ROI, and financial projections.

Think of a business plan as your company’s “owner’s manual” and a funding proposal as your “sales pitch” to investors. Both may share overlapping sections, but the proposal is more persuasive and focused on how investors benefit from participating.

Q3. Do I need professional help to write a funding proposal?

Answer: Not necessarily, but it can help. Many entrepreneurs write successful proposals themselves by following structured guidelines. However, if you lack writing skills or financial expertise, hiring a consultant or proposal writer can increase your chances of success.

Professionals bring objectivity, polished presentation, and industry-standard formatting. They can also help refine financial models and identify weaknesses. If hiring is outside your budget, consider peer reviews, online templates, and workshops as cost-effective alternatives.

Q4. What makes investors reject a proposal immediately?

Answer: Several red flags can cause instant rejection: unrealistic projections, lack of market research, unclear ROI, unprofessional formatting, or a weak team. Investors also dislike generic proposals that clearly weren’t tailored to them.

To avoid rejection, ensure your proposal is data-backed, investor-focused, and polished. Proofread thoroughly, double-check financials, and present a clear path to profitability.

5. How can I make my proposal stand out?

Standing out requires more than flashy graphics. Focus on clarity, storytelling, and evidence. Use real-world case studies, customer testimonials, or pilot results to prove traction. Show passion but balance it with logic.

You can also differentiate your proposal by customizing it to each investor’s portfolio. Highlight how your business aligns with their past investments or values. This shows you’ve done your research and are serious about building a partnership.

Conclusion

Writing a funding proposal that attracts investors is both an art and a science. It requires blending compelling storytelling with rigorous data, demonstrating not only why your idea is exciting but also why it is financially sound.

A successful proposal clearly explains the problem you are solving, the opportunity in the market, and the tangible benefits investors will gain. It avoids jargon, communicates passion, and builds credibility through evidence. Above all, it focuses on the investor’s perspective, answering the unspoken question: “What’s in it for me?”

By following the structure outlined in this guide, avoiding common mistakes, and tailoring your approach to each investor, you can dramatically improve your chances of securing the funding you need to bring your vision to life.