Peer-to-Peer Lending for Entrepreneurs in 2025: A Comprehensive Guide

Peer-to-peer (P2P) lending has rapidly evolved as a mainstream funding option for entrepreneurs and small business owners, offering an alternative to traditional bank loans.

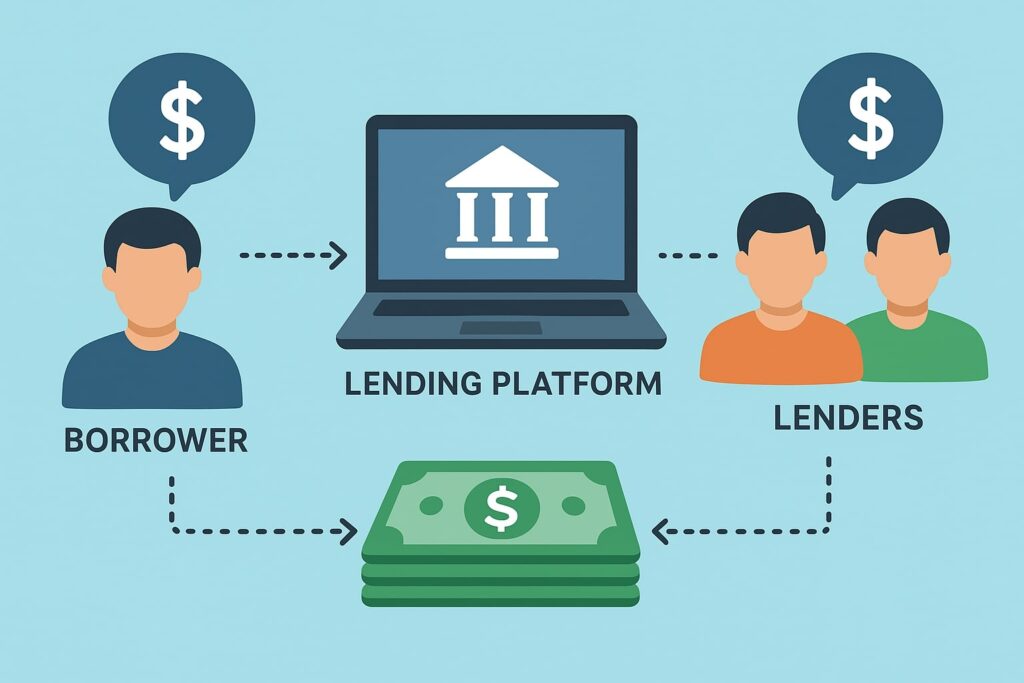

In a P2P marketplace, online platforms directly connect individual investors to business borrowers, bypassing banks and enabling loan terms often faster and more flexible than conventional financing.

By 2025 the P2P lending market is booming: the global market was roughly $139.8 billion in 2024 and is projected to reach over $1.38 trillion by 2034. This guide explores how P2P lending works, its pros and cons for entrepreneurs, and practical tips on using it to finance a small business in the USA.

What Is Peer-to-Peer (P2P) Lending?

Peer-to-peer lending (also known as crowdlending or marketplace lending) is a technology-driven process where individuals or institutions fund loans to other individuals or small businesses through online platforms.

Unlike a bank loan, which pools depositor funds, P2P loans come directly from investors seeking a return. For example, on a P2P site an entrepreneur posts a loan request (including purpose, amount, and credit profile).

Investors then choose to fund all or part of that loan. The platform automates credit checks and payment flows, so after approval the funds are transferred to the borrower and monthly loan payments flow back to the investors.

This peer-driven model means P2P platforms often attract borrowers who may not fit traditional bank criteria. A study notes that P2P loans “offer borrowing options for entrepreneurs, small business owners, and other individuals who might not fit the profile of the ideal loan recipient by traditional banking standards”.

In practice, P2P loan applications tend to involve less paperwork and faster credit-scoring algorithms. However, the trade-off is that interest rates and fees may be higher than a bank’s, reflecting greater risk for lenders.

How Peer-to-Peer Lending Works

Most P2P lending platforms follow a similar process:

- Online Application: The entrepreneur applies through the platform, providing business details (name, address, revenues, etc.), desired loan amount, and personal/business credit information. Applicants are often assigned a risk grade or credit score by the platform’s algorithm.

- Loan Listing: The platform posts the loan request and credit rating. Investors on the site review listings and decide which loans to fund, either in whole or by contributing smaller portions of the total amount.

- Funding: Once investors commit (often within days), the loan is fully funded. The platform forwards the funds to the borrower.

- Repayment: The borrower repays the loan in fixed monthly installments (principal + interest), and these payments are distributed back to the investors. P2P business loans are typically fixed-rate, fixed-term loans with uniform monthly payments.

Some lenders (like Kiva) even offer 0% interest microloans for micro-entrepreneurs. But most P2P business lenders charge interest based on the borrower’s credit profile.

Borrowers with strong credit can often secure interest rates competitive with or slightly above bank rates, while those with riskier profiles pay substantially more. Many P2P platforms emphasize speed and convenience.

In the USA and Europe, platforms like LendingClub or Prosper advertise fast turnarounds: borrowers can sometimes receive an initial loan decision in minutes to days, and funding typically occurs within days to a week. For busy founders, this digital process can be far quicker than a traditional loan application.

Market Growth and Trends (Global and U.S.)

P2P lending has seen explosive growth worldwide. In 2023, the global P2P market was about $200 billion and growing at roughly 18% annually.

Precedence Research forecasts this market to soar from $139.8 billion in 2024 to $1.38 trillion by 2034 (a 25.7% compound annual growth rate).

North America (led by the USA) is one of the largest P2P markets. In 2023, North America’s P2P volume was about $88 billion (13% growth from 2022).

The U.S. accounts for the bulk of that. In fact, North America alone represented roughly 37% of the global P2P market in 2024. For comparison, Europe had about 28% share, and Asia-Pacific about 24%.

Within the P2P sector, business loans are a major segment. CoinLaw reports that small business loans account for about 35% of global P2P lending volume. This share is growing as more entrepreneurs discover P2P.

In the U.S. specifically, P2P business lending has been increasing: a recent estimate found that P2P loans made up about 5% of total U.S. personal loan volume in 2023, up from 3.5% in 2022.

Many experts believe the business lending side of P2P will expand even faster than consumer loans over the next decade.

Key trends shaping P2P in 2025 include:

- Advanced credit scoring: Platforms increasingly use AI and alternative data (e.g. social media, mobile payment history) to assess creditworthiness. This “alt-data” underwriting can approve entrepreneurs who lack traditional credit files.

- Embedded financing: P2P models are merging with “buy-now, pay-later” and other point-of-sale financing solutions, allowing businesses to access capital right at the moment of need.

- Decentralized finance (DeFi): Some P2P platforms are experimenting with blockchain-based loans, where funding and repayments occur via smart contracts. This is an emerging frontier, not yet mainstream for small businesses.

- Regulatory evolution: In the U.S., P2P lending is regulated under securities and lending laws. Platforms must navigate SEC rules and state “blue sky” laws, which can limit where they operate. Entrepreneurs should ensure any platform is licensed and compliant.

Overall, the outlook is clear: P2P lending is a growing part of the small-business financing ecosystem. As one study notes, small businesses have increasingly pivoted to P2P funding when traditional credit dried up, underscoring the value of offering diverse funding tools.

Advantages of P2P Lending for Entrepreneurs

P2P lending offers several compelling benefits to founders and small business owners:

- Easier Access When Banks Say No: Because P2P platforms use modern credit models and many online lenders aim to serve underserved segments, entrepreneurs who have been rejected by traditional banks can often secure funding through P2P.

As an SBA research brief observes, P2P loans “serve credit needs in markets where financial institutions would not traditionally lend,” thus enabling businesses to finance growth or emergencies.

For example, a boutique owner who lacked collateral once obtained a loan via P2P after a bank turned her down. - Fast, Convenient Process: P2P applications are online and streamlined. Many platforms advertise quick approvals and funding.

The SBA’s analysis notes that forms are simple and approvals can come in days (LendingClub quotes within minutes; Kabbage approves same-day; OnDeck funds within 24 hours). Founders save time compared to the often long, paper-heavy bank process. - Flexible Loan Options: P2P platforms offer a range of loan sizes and terms. While bank loans often start in the tens of thousands, P2P loans can be as small as a few thousand or up to around $100,000.

P2P loans are typically fixed-rate, fixed-term installment loans (e.g. 1–5 year terms) which gives entrepreneurs predictability. Some platforms even offer specialized products like lines of credit or equipment financing. - No Collateral Required (Often): Unlike many bank loans, most P2P business loans are unsecured, relying on the borrower’s credit and business finances rather than physical collateral.

This can open doors for startups and small firms without significant assets. However, some platforms may still require a personal guarantee. - Transparent Terms: Most P2P marketplaces clearly state all fees (origination fees, late fees, etc.) up front.

Borrowers can compare offers from multiple investors and choose the terms that suit them. There are no surprises like hidden bank charges, and repayment schedules are fixed. - Alternative Credit Models: Many P2P platforms use sophisticated analytics. They might consider non-traditional data (cash flow, invoices, online sales, education, employment history, etc.) to approve loans.

This can benefit entrepreneurs who lack a sterling credit score but have strong business performance. - Potentially Lower Rates for Good Credit: While P2P rates are generally higher than the cheapest bank rates, very creditworthy businesses may still get competitive interest.

In fact, borrowers with strong profiles often pay rates lower than comparable bank rates, because P2P platforms calculate risk more granularly.

In summary, P2P lending can fill financing gaps for small businesses by offering speed, flexibility, and broader access. It complements the finance toolkit for entrepreneurs, especially in a digital-first era.

Challenges and Risks of P2P Lending

While P2P lending can help entrepreneurs, it also has downsides and risks to consider:

- Higher Interest and Fees: P2P loans are generally pricier than bank loans. A Federal Reserve–sponsored study found that peer-to-peer small business loans tend to carry higher interest rates than traditional bank loans or even business credit cards.

The SBA issue brief notes that easier access comes with the cost of higher rates. Entrepreneurs should expect interest rates often in the double-digit range, with more creditworthy borrowers paying mid-teens and riskier borrowers possibly paying 20–30% or more. - Default Risk: Because P2P platforms extend credit to riskier borrowers than banks might, the default rate on P2P loans is significantly higher than bank loan delinquency rates.

Research cited by Investopedia indicates P2P loan defaults often exceed 10%, whereas overall bank loan delinquency has historically stayed below 7.5%.

While default harms investors, borrowers also feel it: failing to repay a P2P loan can hurt personal and business credit scores. - Regulatory Uncertainties: P2P loans in the U.S. can be subject to securities law (if the loan is deemed an investment contract) and to state money-transmission regulations.

Platforms have to navigate these rules, and some have been forced to restrict lending in certain states. Entrepreneurs should ensure their chosen platform is legally registered and licensed in their state. - Limited Liquidity: Unlike stocks, P2P loans are not easily sold on a secondary market. Once you take a P2P loan, you usually must repay it until maturity.

(From an investor’s view, this is a drawback; for borrowers it just means you can’t easily refinance it mid-term without penalty or paying it off entirely.) - Platform Risk: If a P2P platform fails or gets shut down, there can be complications. Most platforms have contingency plans, but borrowers should be cautious about placing all trust in a new or untested fintech. Reputable, established platforms and thorough due diligence can mitigate this risk.

- Borrower Qualification: Not every entrepreneur will qualify. Common criteria include a minimum credit score (often around 600), a couple of years of business history or revenue, and detailed financial documentation. Startups with very short track records or poor personal credit may find it hard to get approved.

Comparison of Lending Options for Small Businesses

| Feature | Peer-to-Peer Lending | Traditional Bank Loan |

|---|---|---|

| Typical Loan Size | Smaller (often $1,000–$100,000) | Can be much larger (up to millions) |

| Collateral Required | Usually unsecured (based on credit) | Often requires collateral or personal guarantee |

| Approval Speed | Fast (days to a few weeks online) | Slow (weeks or months) |

| Interest Rate | Higher (often 10–30%, depending on credit) | Lower (can be 5–15% for qualified borrowers) |

| Credit Needed | Moderate (often FICO ~600+) | Stricter credit requirements |

| Application Process | Fully online with minimal paperwork | More paperwork and underwriting |

| Repayment Term | Fixed-term loans (1–5 years typical) | Longer terms possible (up to 5–10+ years) |

| Use of Funds | Business expansion, equipment, etc. (varies) | Any qualified business purpose |

| Regulation | Platforms must comply with SEC/state rules | Regulated by banking laws and SBA rules |

This comparison highlights that P2P lending trades some cost (higher interest) for convenience and accessibility. It is best suited for smaller, shorter-term needs or for borrowers who have limited options with banks.

How to Apply for a P2P Business Loan

Applying for a P2P loan is straightforward but does require preparation. Entrepreneurs should follow these steps:

- Check Your Credit and Finances: P2P lenders usually require a minimum credit score (often around 600 or higher). Review personal and business credit reports to ensure there are no surprises.

Assemble key financial documents: recent bank statements, tax returns, profit/loss statements, and any business plan or projections. - Gather Business Information: Be ready to provide business details such as your company’s legal name, address, structure (LLC, S-Corp, etc.), number of employees, and monthly revenues.

Many platforms also want to know how long you’ve been in business (some require at least 1–2 years of operations). - Research and Choose a Platform: Look for reputable P2P lending marketplaces that serve small businesses.

(Examples include LendingClub, Prosper, Funding Circle, Kiva, etc., though new platforms continually emerge.) Check reviews and ensure the platform is licensed to lend in your state. - Complete the Online Application: Fill out the online loan form on the platform. This typically takes only a few minutes. You will enter the loan amount and purpose, and upload any required financial documentation.

- Review Offers: After submission, the platform’s credit model will evaluate your request. In a couple of days (sometimes within hours), you may receive loan terms or rates.

Some platforms automate this, others may have lenders manually review profiles. Compare the effective annual percentage rates (APR) and fees of any offers you get. - Accept the Loan: Once you find a satisfactory offer, accept it through the platform. The funds are then transferred to your bank account.

P2P loans typically have origination fees (often 1–6% of the loan), which are usually deducted from the disbursed amount. The remaining balance is yours to use for the business. - Repay on Schedule: Make monthly payments as agreed. Setting up automatic payments can ensure you never miss a due date. Timely repayment can build your credit profile with the platform and strengthen your relationship with investors.

Platforms like LendingClub, Prosper or OnDeck explicitly advertise their fast approval times: for example, LendingClub claims applicants can get a quote in minutes and funding within about 7 days.

Others like Kabbage or BlueVine emphasize funding in 1–3 days once approved. Always read the loan agreement carefully before signing, paying attention to the interest rate (APR), any prepayment penalties, and fees.

Future Outlook for P2P Lending (2025 and Beyond)

The P2P lending landscape continues to evolve. Entrepreneurs in 2025 can expect:

- Wider Adoption by Small Businesses: With fintech awareness growing, more entrepreneurs will consider P2P as a viable option.

Recent research found that small business owners who struggled to find bank credit during the pandemic increasingly turned to online P2P lenders to “weather economic storms”. - Integrated Financial Solutions: Many fintech firms are embedding P2P loans into broader digital financial services (accounting software, payments, etc.).

For example, some POS systems now allow merchants to finance equipment via investor pools at checkout. This trend means entrepreneurs may access P2P funding as part of other business services. - Continued Regulatory Scrutiny: In the U.S., regulators have been monitoring P2P lending. The SEC requires that certain P2P debt offerings be registered or only offered to accredited investors.

In 2025, platforms will likely continue strengthening compliance and transparency to satisfy regulators and investors alike. Borrowers should stick to well-established lenders with clear regulatory standing. - Technology Integration: AI-driven credit analysis and blockchain-based contracts are likely to become more common. This could further speed up approvals and even introduce crypto-collateralized loans. Entrepreneurs should watch for these innovations, but also ensure security and reliability.

- Market Competition: The success of P2P has attracted many new entrants, including nonbanks and even banks launching online branches. Increased competition is likely to drive better service, but could also lead to platforms consolidating.

Entrepreneurs will have to choose among many options, so comparing platform performance (rates, customer service, approval speed) will be important.

In summary, P2P lending is poised to play a bigger role in small business finance. Entrepreneurs should view it as a complementary option—one that offers accessibility and speed, at the cost of potentially higher rates.

In 2025 and beyond, savvy small business owners will leverage P2P loans alongside traditional channels, using whichever best fits their needs at the time.

Frequently Asked Questions (FAQs)

Q: What is peer-to-peer lending and how is it different from a bank loan?

A: Peer-to-peer (P2P) lending is an online system where individual investors fund your loan directly, bypassing banks. The process is managed by a P2P platform. Unlike banks, P2P platforms typically have quicker online applications and may lend to businesses with limited track records. However, P2P loans are usually smaller and often carry higher interest rates than traditional bank loans.

Q: How quickly can I get funding through a P2P loan?

A: Many P2P lenders approve loans much faster than banks. After applying online, you could get a decision within days and funds in your account often within a week.

For instance, LendingClub advertises that borrowers can get a quote in minutes and receive funding in about 7 days, while some lenders (like Kabbage or OnDeck) can fund loans in as little as 24–48 hours.

Q: What credit score or history do I need to qualify?

A: P2P business lenders typically look for a credit score around 600 or higher, though exact requirements vary. They also may require 1–2 years of business history or revenue.

Stronger financials and credit will yield better interest rates. Even if your personal credit is fair, having solid business revenue can help, because many platforms consider both business and personal financial information.

Q: What interest rates can I expect on a P2P small-business loan?

A: Rates vary widely by platform and borrower credit. Generally, P2P business loan rates range from roughly 10% up to 30% APR. Good-credit borrowers might see rates in the low teens, while higher-risk borrowers can pay much more.

By comparison, traditional bank loans (for strong borrowers) often have single-digit rates. Always check the Annual Percentage Rate (APR), which includes fees. The SBA report notes that P2P rates tend to be higher than most bank loans or business credit cards.

Q: Is a P2P loan insured or protected like a bank loan?

A: No. P2P loans are NOT backed by the FDIC or any government insurance. If the platform fails, lenders (and sometimes borrowers) could be impacted.

This is why it’s important to borrow only through reputable platforms. Also, understand that if you default, the lender investors bear the loss, not a federal insurer.

Q: Can I get a P2P loan with bad credit or as a startup?

A: It depends. Some P2P platforms use alternative data and may consider your overall business potential, which can help if your credit is imperfect. However, most require at least a fair credit score (often 600+) and at least some history (even 1 year) of operations.

Very new startups or those with poor credit may find it challenging to qualify. Microloan crowdfunding (like Kiva, though limited in amounts) is an exception: Kiva offers 0% loans up to $15,000 to entrepreneurs with no collateral or credit score required.

Q: What fees are involved in a P2P loan?

A: Common fees include an origination fee (often 1–6% of the loan), late payment fees, and possibly processing fees. These are usually deducted from the loan amount upfront.

Some platforms also charge a fee when setting up or managing payments. The loan’s APR includes these fees. Always review the fee schedule before accepting an offer to know your true cost.

Q: How do P2P loans affect my credit score?

A: Like any loan, a P2P loan will appear on your credit report if the platform reports it (many do). Timely payments can help build credit. Missing payments can hurt your score.

Unlike credit cards, P2P loans are installment loans, so they will factor into your debt-to-income ratio. Treat it as a formal loan: make payments on time to protect your credit.

Q: Are P2P loans regulated?

A: Yes, to an extent. In the U.S., P2P lending platforms often fall under securities and lending laws. The SEC requires that certain loan notes be registered or only offered to accredited investors.

Many states also have regulations on lending platforms (some states require licenses). Borrowers should ensure the platform complies with federal and state laws. Reputable platforms will make their licensing transparent on their websites.

Q: What alternatives exist if P2P is not right for me?

A: Other small business funding options include traditional bank loans or lines of credit, SBA-guaranteed loans, business credit cards, invoice financing, and crowdfunding (equity or donation-based). Each has its own requirements.

For example, SBA loans have relatively low rates but strict eligibility. Credit cards are quick to obtain but very high-interest. P2P is just one tool, best used when its speed and accessibility match your needs.

Q: How can I choose a good P2P platform?

A: Compare platforms based on loan terms, funding speed, interest rates, and user reviews. Look at BBB ratings or fintech review sites. Check if the platform is well-established and whether it has had any regulatory issues.

Some platforms are general, while others specialize (e.g. equipment finance, real estate, or specific industries). Read feedback from other small-business borrowers. A good choice is one that fits your loan size and needs with transparent terms.

Conclusion

Peer-to-peer lending has matured into a significant financing avenue for U.S. entrepreneurs and small business owners. By 2025, it provides a digital marketplace where borrowers can secure capital when traditional banks may be slow or unwilling.

As one analysis notes, P2P “offers borrowing options for entrepreneurs… who might not fit the profile” of bank borrowers. This means startups and growing businesses have another way to manage cash flow, expand operations, or invest in new opportunities.

However, it’s crucial to remember the trade-offs: P2P loans usually come with higher interest and risk. Entrepreneurs should carefully compare rates, read terms, and borrow only what they can repay.

When used judiciously, P2P lending can be a powerful tool in the small business finance toolkit, complementing banks and other alternatives.